Push for high-tech plants drives up cost of incentives

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

National efforts to boost computer chip and electric vehicle production are fueling a bidding war among states, including Indiana, that is driving up the cost and number of so-called “megadeal” incentive packages exceeding $50 million.

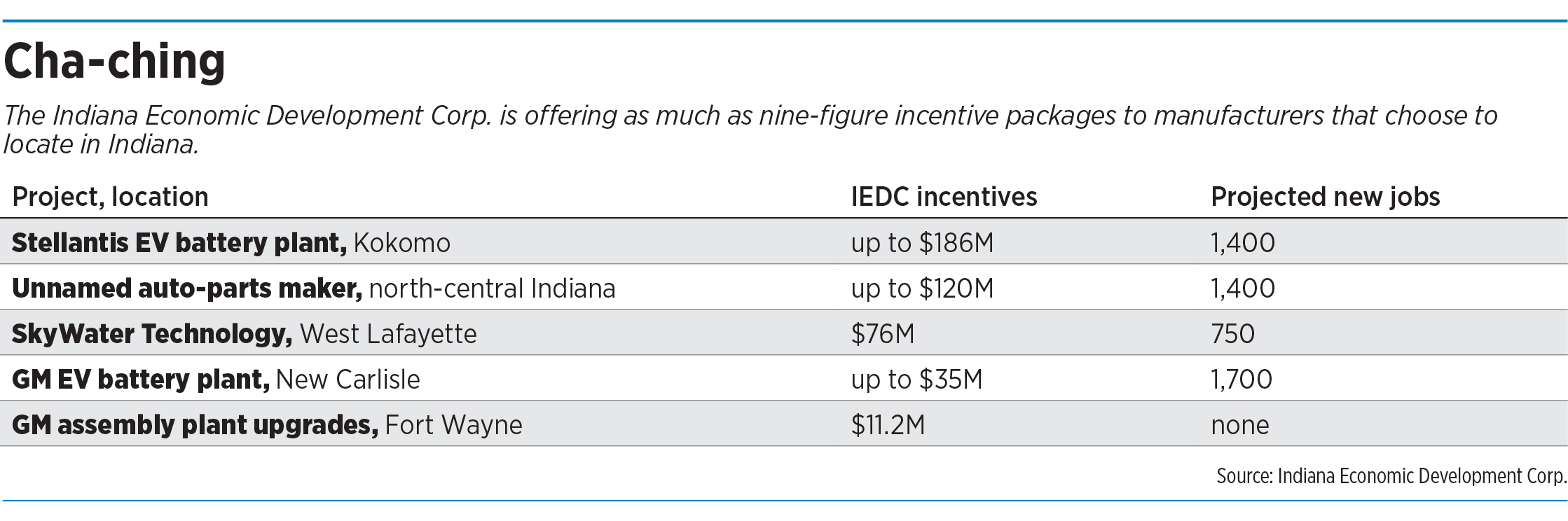

Last year, Indiana offered $186 million to automaker Stellantis for a $2.5 billion electric-vehicle battery plant in Kokomo, which is expected to open in 2025 and create up to 1,400 jobs.

That package was a small piece of a record $20 billion worth of “megadeals” given out in 2022, according to Good Jobs First, a Washington, D.C.-based not-for-profit that tracks corporate subsidies under a critical lens.

Earlier this year, Indiana lawmakers signed off on another potential megadeal. The Indiana Economic Development Corp., the state’s quasi-governmental economic development organization, offered a $120 million incentive package for an unnamed auto-parts maker looking to construct a $3.2 billion manufacturing facility in north-central Indiana that will employ an estimated 1,400 workers. That equates to the state paying roughly $85,000 per job. The subsidy package for the Stellantis plant in Kokomo equates to $132,000 per job.

Minnesota-based semiconductor manufacturer SkyWater Technology is building a $1.8 billion R&D and production plant adjacent to the Purdue University campus in West Lafayette. The project is expected to result in 750 high-wage jobs within five years of opening, according to the IEDC, which plans to support the project with more than $76 million in incentives—about $101,000 per job.

Economic development leaders say the cost is necessary to be a player in the high-tech advanced-manufacturing sweepstakes, but some economists question whether the benefits are worth the price.

Michael Hicks, director of the Center for Business and Economic Research at Ball State University, said Indiana should be paying closer to $20,000 per job for the unnamed auto-parts maker project, which he said is roughly how much average workers employed there would expect to pay in taxes over the next 30 years.

“The problem with this deal is that it just doesn’t get anywhere near a realistic benefit-cost ratio,” Hicks said. “I think that is ultimately the failing of the analysis.”

State officials rebuff suggestions that they have gone too far.

“We’re not [at the point], or we wouldn’t do it,” said Gov. Eric Holcomb. “We’re always going to be thinking bigger and bolder to be able to keep up with the competition and provide opportunities for Hoosiers well into the future.”

David Rosenberg, the newly appointed secretary of commerce who also acts as CEO of the IEDC, said the amount and types of incentives vary depending on the nature of the project. Every negotiation is different and each project unique, and the IEDC works closely with companies and local officials to determine the needs of a company.

“It’s important to remember that these incentives are based on what the state sees as a return, and so they’re calculated based on what the company will pay in taxes over a certain period of time,” Rosenberg told IBJ.

The IEDC declined to share how incentives were calculated for specific projects, but a spokesperson said the agency’s business development team, before any incentives are offered, conducts “a robust risk, legal and financial due-diligence review, a weighted deal scoring, a cost-benefit analysis, and an internal rate-of-return analysis that are considered alongside a project forecast.”

Also, companies receive the incentives only if they meet their job-creation commitments.

Cost of doing business

Nationally, last year was a record-breaker in terms of mega economic development deals.

In 2022, there were eight agreements in which companies were offered at least $1 billion in subsidies for a single facility, many of which were electric vehicle plants, EV battery factories and microchip fabrication facilities, according to Good Jobs First.

The year prior, only one company, Samsung, received more than $1 billion—for a chip plant in Texas—and subsidy packages of that size were doled out only seven times in the previous decade.

This year, Georgia and local governments are on track to give $2.1 billion in tax breaks and other incentives to Hyundai Motor Group and battery maker LG Energy Solution for a $7.6 billion electric vehicle complex that would employ 8,500 workers by the end of 2031, the Associated Press reported.

Despite the high cost of landing such huge projects, Indiana leaders say the return is even larger and they won’t stand on the sidelines watching other states try to cash in on an American manufacturing renaissance.

Some economists are bullish on entering the incentive war for significant projects they see as wealth generators for regional economies.

“It’s different than a tax abatement for a Walmart,” said Philip Powell, professor of business economics and public policy and executive director of the Indiana Business Research Center at the Indiana University Kelley School of Business. “The [federal] CHIPS and Science Act is creating huge incentives for regions to build these new manufacturing ecosystems for products that we used to just delegate overseas, so it’s going to make sense that the competition is going to intensify because they’re bolstered by these federal benefits. I’m on board with that.”

But economists like Hicks argue that “the promiscuous use of incentives robs resources from actually productive efforts to boost the Hoosier economy.”

“Local subsidies, which are required under IEDC policy, take money directly out of local government efforts to reduce crime, improve schools and improve quality of life,” Hicks said. “The state incentives take money directly from funding the key public services that attract residents and non-manufacturing businesses.”

Measuring the return on the state’s investment is a tricky task, critics say.

The IEDC publishes annual reports that detail how much private investment and job commitments it has secured, but because the agency is quasi-governmental, it doesn’t have to release certain data points.

“There’s just so much that we don’t know,” said Stephanie Wells, executive director of the Indiana Fiscal Policy Institute.

New money

More than 450 companies from 42 states have already applied for the first round of $39 billion worth of subsidies made available through the CHIPS and Science Act, according to the U.S. Department of Commerce.

The other component of the CHIPS Act offers $13 billion for regional technology and innovation hubs, and Indiana is directly competing with its Midwestern neighbors for one of three planned hubs in the region.

Heartland Bioworks, a consortium of Hoosier stakeholders in the fields of advanced manufacturing and biotechnology, submitted an application to the U.S. Economic Development Administration for official designation, which would make it eligible for up to $75 million in federal funding.

The Inflation Reduction Act has made federal subsidies available for clean energy projects like electric vehicle battery plants, and states are already seeing results.

“We didn’t have any EV battery facilities 18 months ago, and now there’s multiple operating in the state,” Rosenberg said. “Those first movers, sometimes you give an incentive, and it’s still a positive return to the state. It’s really important that you look at the ecosystem they bring. They bring their entire supply chain, and those companies have to be within direct proximity [of] that main facility, and so then it’s kind of shooting fish in a barrel where you’re getting higher and higher returns on that investment.

“You may have been more aggressive on that initial investment, but once they bring in their supply chain and you look at the overall deal, it’s very much double digits in terms of the [return on] investment made by the state.”

The modern landscape

Economic development leaders have long argued that manufacturers want “shovel-ready” sites where they can begin building without having to acquire land themselves or tangle with local zoning boards. In response to this trend, the IEDC has embarked on a strategy of buying up large swaths of land and creating “megasites” to attract global manufacturers.

When Mitch Daniels became governor in 2005, he wasted no time in changing how the state would pursue economic development projects. He created the IEDC (and made himself its board chair). The goal, Daniels said, was to position Indiana to “act at the speed of business, not at the speed of government.”

The Republican-led supermajority in the Legislature has proven to be accommodating to this strategy.

In the most recent state budget, lawmakers gave the IEDC unprecedented levels of funding, including $500 million for a deal-closing fund; $500 million for READI 2.0, a third wave of regional economic development grants; and $150 million for a revolving site-acquisition fund.

In early 2022, the IEDC began the process of secretively buying up large swaths of land in Boone County for a manufacturing and innovation district, dubbed the LEAP Lebanon Innovation District, on what is mostly farmland (LEAP stands for Limitless Exploration/Advanced Pace) north and west of Lebanon along Interstate 65, a rough halfway point between Purdue University and Indianapolis.

In June, legislators approved the IEDC’s request for $122 million to acquire roughly 1,000 acres of land in the district for a potential $50 billion semiconductor plant investment.

Some economists and Democratic lawmakers have raised concerns about the latitude the IEDC has been given to pursue its strategy.

“I’m still waiting to understand what is the real return on investment that we get from these companies that come here,” said Rep. Greg Porter, the ranking Democrat on the State Budget Committee that approved the IEDC’s funding request.

Indiana has lost out on other projects, like when Intel chose Ohio last year for a $20 billion semiconductor plant. Indiana was competing for that project, according to The New York Times.

“Ohio’s speed of response surprised Intel,” said Matt Englehart, communications manager for JobsOhio, a private not-for-profit economic development corporation similar to the IEDC that works alongside the Ohio Department of Development. “Due to our JobsOhio Network, we met with the company and conducted a statewide search for a site that checked the boxes of Intel’s stringent requirements in three days.”

IEDC officials have said the model for the LEAP District is based in part on the North Carolina Research Triangle, a metropolitan area near three Tier 1 research universities: Duke University, the University of North Carolina and North Carolina State University.

“Fifty years ago, Raleigh was a sleepy government town. It wasn’t a tech and life sciences hotbed like it is today,” said Christopher Chung, CEO of the Economic Development Partnership of North Carolina.

Chung said he has been watching the LEAP District with interest.

“I think they have all the right ingredients,” he said. “Time is going to tell because it’s something that’s going to span multiple administrations, and there’s going to have to be a steady commitment to investing, developing, marketing and nurturing the vision. But I applaud the vision.”

Meeting the moment

Indiana is routinely ranked as one of the nation’s most business-friendly states, but it fails to meet the mark when it comes to availability of skilled workers to fill what the IEDC calls “future-focused” jobs.

Once a leader in manufacturing, Indiana’s labor productivity has failed to keep pace with the rest of the country.

From 2007 to 2021, real labor productivity went up 18% nationwide but only 3% in Indianapolis, according to data from the Indiana Business Research Center.

Indiana lags many competitors in skilled workers to fill high-tech jobs, according to Gerald Cohen, chief economist at the Frank H. Kenan Institute of Private Enterprise at the University of North Carolina at Chapel Hill.

“You can bring in high-tech industries, but you also need the workers for those industries,” Cohen said. “Indianapolis has some of those, but it’s not showing as a place where, if I were a business, I would immediately look to move.”

Indiana leaders are working to change that narrative.

In 2018, state lawmakers created the Governor’s Workforce Cabinet, a group of business executives, education leaders, government officials and other stakeholders responsible for distributing funds to Indiana’s 12 workforce development boards. In the most recent state budget, lawmakers allocated $16 million to the cabinet to spend on workforce initiatives.

And the Indiana Department of Education is in the process of rolling out a program that allows eligible high school students to receive up to $5,000 for “career scholarship accounts” to “shop” for work-based learning experiences to help them earn a post-secondary credential before graduation.

“It reflects a shift away from only looking at cash transfers to companies,” said Ellen Harpel, founder and CEO of Smart Incentives, a Virginia-based research organization that helps economic development organizations form incentive programs. “It’s about investing in yourself as well.”