Part of Indiana’s New Vaping Tax Cut Before Taking Effect

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

Indiana’s new tax on vaping is being cut even before it takes effect despite protests from anti-smoking advocates.

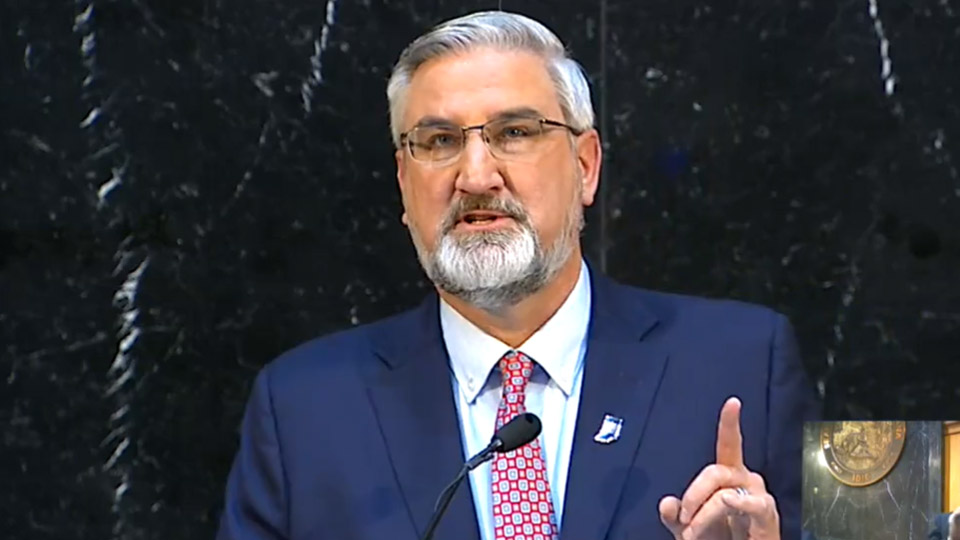

Governor Eric Holcomb signed a bill this week that included provisions cutting the 25% tax that wholesalers were to be charged for closed-system vaping cartridges such as Juul devices to 15%. State lawmakers approved the higher rate last year for Indiana’s first tax on electronic cigarettes to start in July 2022.

But the Republican-dominated Legislature approved the lower rate with seven lines included in a 118-page bill on mostly technical tax law changes.

Republican Sen. Travis Holdman of Markle, chairman of the Senate’s tax committee chairman, said the vaping device tax change was made to bring it in line with the 15% rate set last year for refillable vaping products. Holdman said the intention was to have all vaping devices and products taxed the same.

Health groups and the Indiana Chamber of Commerce had urged lawmakers to keep the 25% rate, arguing they believed vaping devices should face taxes similar to tobacco products to discourage young people from starting to use them.

Bryan Hannon of the American Cancer Society said the vaping device tax should be at least 20% to achieve parity with Indiana’s 99.5 cents-per-pack cigarette tax.

Those organizations have pushed unsuccessfully over the past several years to boost the cigarette tax that’s been unchanged since 1997 in hopes of lowering the state’s 19.2% smoking rate for adults, which was the country’s 10th highest for 2019, according to the federal Centers for Disease Control and Prevention.