New state law fills insurance coverage gap on inheritance

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

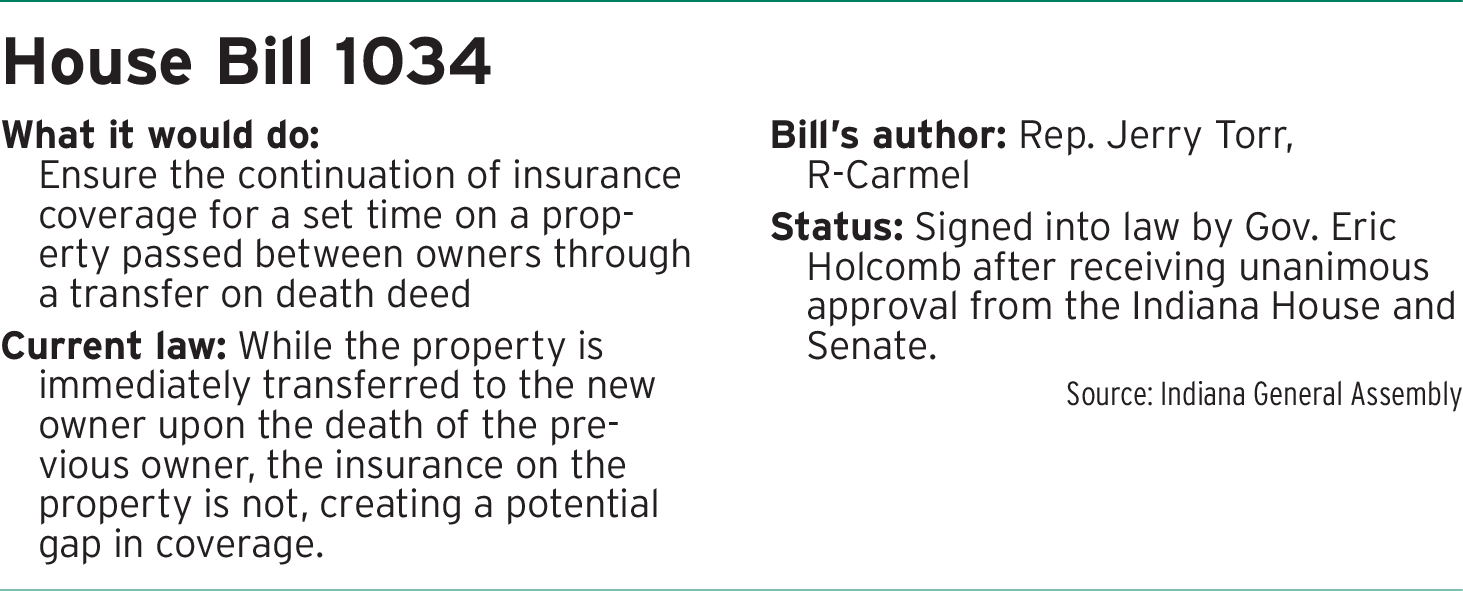

A new law signed by Indiana Gov. Eric Holcomb represents a new step in supporting beneficiaries who gain ownership of property through transfer on death deeds.

Under House Bill 1034, beneficiaries in these deeds will temporarily maintain insurance coverage under the deceased person’s policy immediately upon gaining the property.

This gives the new owners time to find their own insurance coverage without losing protection against a fire or some other calamity. Previous state law did not provide such “gap” coverage.

Transfer on death deeds

HB 1034 specifically focuses on the extension of insurance as it relates to transfer on death deeds, a type of estate planning document that allows the transfer of ownership on a property without going through probate.

Under Indiana Code 32-17-14-3, a transfer on death deed is a “deed that conveys an interest in real property to a grantee by beneficiary designation.”

For attorney Annette Brogden, a Carmel solo practitioner who specializes in trust and estate planning, transfers on death deeds are an attainable way for individuals to plan their estate, regardless of their level of wealth or access to legal services.

“It’s particularly important to individuals who may have limited resources and limited estates and may not be able to establish trust to be able to pass their property without probate to a family member,” Brogden said.

Up until now, however, a risk with pursuing a transfer on death deed was the gap in the insurance coverage on the deed, potentially leaving beneficiaries high and dry in the event of a catastrophe.

How the House bill came to be

For Brogden and many others, inspiration for HB 1034 stemmed from a case in Minnesota that gained national attention, shining a light on the disparity in insurance coverage beneficiaries experience soon after the original owner of a property dies.

In Dawn Strope-Robinson v. State Farm Fire and Casualty, 20-1147, the plaintiffs, Dawn Strope-Robinson and the estate of her deceased uncle, David Clair Strope, filed an appeal against State Farm to claim insurance on Strope’s house, which was intentionally burned down by his ex-wife after his death.

Strope named his niece, Strope-Robinson, as the beneficiary of his property in a transfer on death deed. Before he died, State Farm Fire and Casualty Company issued insurance to Strope for his property.

However, his death marked the end of his insurance on the property, and when his ex-wife burned it down six days after his death, Strope-Robinson had no insurance to cover the damages.

State Farm ultimately denied Strope-Robinson’s claims for coverage for the loss of the house because she wasn’t a named insured under her uncle’s policy and the actual named insured, her uncle, had “no insurable interest in the home at the time of the fire.”

The insurance company ultimately prevailed in the case at the Eighth Circuit Court of Appeals.

Brogden learned about the case a couple years after it happened and has worked to solve the stark inequity in insurance coverage for this form of estate planning.

“You can have an estate and you can have a house passing through a probate, estate and registration, and there would be coverage extended to that fiduciary,” Brogden said. “Whereas with a TOD deed, upon death, title transferred, there is no insurable interest. And coverage terminates. So, what we were trying to do is to stop that inequity, that unfairness, by extending the insurance coverage.”

What the bill accomplishes

House Bill 1034 corrects a technicality in transfer on death deeds, establishing a 30-to-60-day buffer period of insurance coverage immediately following the death of a property owner.

Within that time frame, the beneficiary of the property has time to establish their own coverage for the property they inherited.

The buffer period depends on the expiration date of the previous owner’s insurance. While 60 days is the baseline, if the transferred policy has an expiration date that’s less than 60 days after the death of the original owner, insurance continues for either 30 days or until the policy’s expiration date, whichever is later.

It’s a compromise made by the bill’s sponsors as the bill went through the Indiana General Assembly.

For bill author Rep. Jerry Torr, R-Carmel, the bill is a tangible way to solve an issue insurance companies already face, seeing it as a benefit to the way they’re able to conduct business.

“My hope is that the insurance companies will evolve over time to take into account what they have had to deal with before,” said Torr.

Indiana is one of just a few states to pass legislation that relates to transfer on death deeds, joining Wyoming and Maine in the effort.

But Brodgen says more states are following suit.

She hopes the Indiana law will ultimately lead to conversations that will help individuals understand how to handle estate planning when the time comes.

“What I’m really hoping is that we can let all the attorneys know throughout Indiana, what happens with regard to [transfer on death] deeds, the gap in coverage that can result and that the attorneys as well as the clients that are using them will talk with their [transfer on death] beneficiaries about the need to get it,” Brogden said. “It’s not a solution to the problem. It just helps.”