Indiana gas tax increases while state eyes inflation relief

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

INDIANAPOLIS - Indiana will see another increase in state gasoline taxes starting July 1 amid promises of inflation relief — including a proposal to issue direct payments to Indiana motorists later this month.

The state’s motorists will pay 62 cents per gallon in taxes on gasoline, the state Department of Revenue announced Monday — another jump from June’s record-high 56 cents per gallon. Fuel costs were expected to continue to rise in July, elevated largely because of Russia’s invasion of Ukraine.

The gas tax increase emerged alongside calls from Indiana Democrats since March to suspend the tax to aid residents reeling from the worst inflation in 40 years.

But Republicans say the gas tax should remain in place to fund the state’s highway construction program and argue that even if the state gas tax was suspended, there is no guarantee that pump prices would be cut by the full amount. They instead backed a plan gradually lowering Indiana’s individual income tax rate over the next seven years.

Indiana has two taxes on gasoline — a 7% sales tax and a tax directed to infrastructure projects.

The sales tax is calculated monthly and will be set at 29.1 cents for July — up 5.1 cents for June and nearly triple the rate from early 2021.

The road projects tax that’s currently 32 cents a gallon is set to go up by 1 cent in July under an automatic increase for inflation allowed under the 2017 plan pushed by Republicans that boosted the tax from 18 cents to 28 cents.

The state’s average price per gallon of regular gasoline was about $5.13 on Monday, above the national average of $4.98, according to AAA.

President Joe Biden said Monday that he will decide by the end of the week whether he would support suspending the federal gas tax of 18.4 cents a gallon.

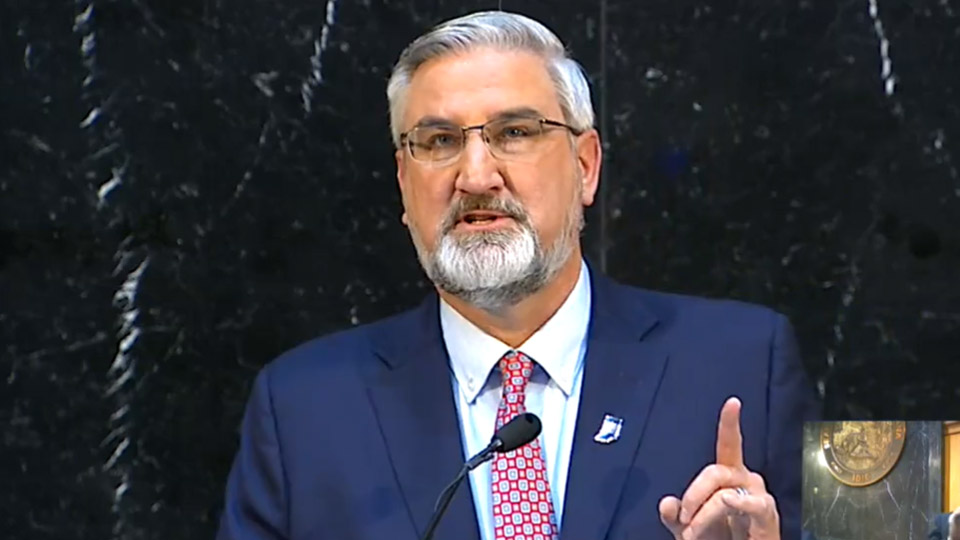

Republican Gov. Eric Holcomb proposed an inflation relief plan this month that would distribute payments of $225 to residents under the state’s automatic taxpayer refund law. This builds on the initial $125 payments taxpayers received last month under the same policy.

Eligible residents would receive a combined total of about $350 in payments, with a married couple filing jointly receiving about $700, Holcomb said.

Holcomb said he would call for a special legislative session before the end of June so legislators can enact this proposal.