Experts say 2023’s sluggish venture activity could last well into 2024

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

A combination of higher interest rates, the ongoing tech industry downturn and general market uncertainty put a damper on venture investment activity last year, both in Indiana and nationwide—and observers say they don’t expect the situation to improve much this year.

“Last year was a tough year for all companies, at all levels,” said Christopher Day, CEO of Indianapolis-based Elevate Ventures. “I think we’re still another year away from things really starting to turn.”

Elevate Ventures invests in Indiana companies and acts as the venture investment arm of the Indiana Economic Development Corp.

Day said Elevate Ventures made $22 million in investment commitments last year, a drop of 29% from the $31 million in commitments the organization made in 2022. Likewise, the number of deals dropped 15%, from 132 in 2022 to 112 last year.

The data analytics firm PitchBook also shows a slowdown.

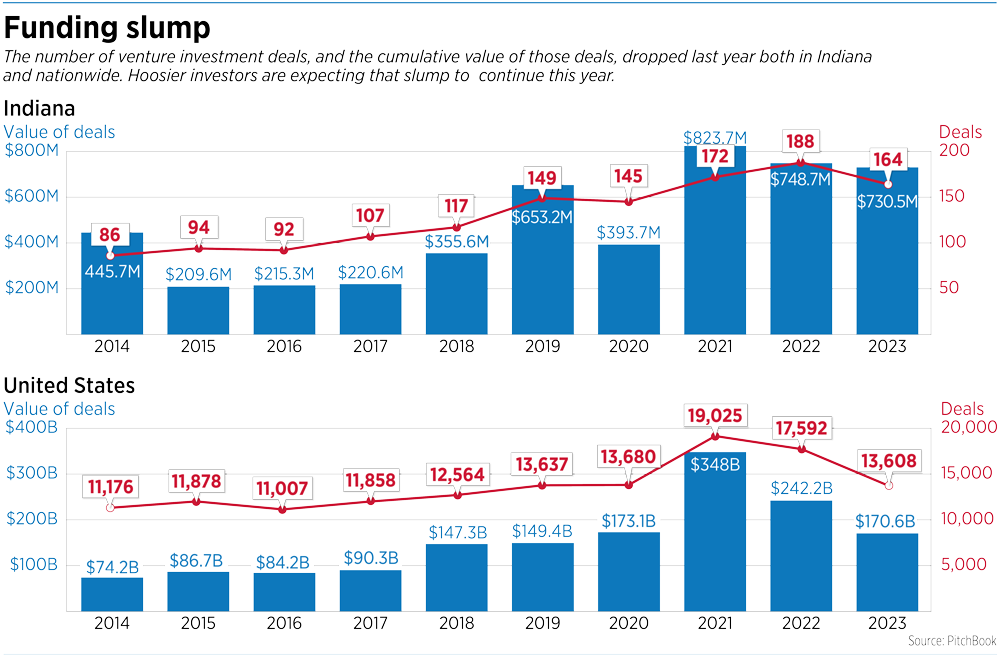

According to PitchBook data, Indiana firms attracted $730.5 million in venture investments last year, down 2% from the $748.7 million they landed in 2022. The number of venture deals dropped 13%, from 188 in 2022 to 164 in 2023.

The slowdown was even more pronounced nationally.

PitchBook data shows that the number of venture deals nationwide dropped 23% last year, from 17,592 in 2022 to 13,608 in 2023. The value of those deals dropped 30%, from $242.2 billion to $170.6 billion.

“Everyone is being more conservative. All investors are looking for more traction, more product/market fit than they have in the past,” said Chelsea Linder, vice president of innovation and entrepreneurship at Indianapolis-based TechPoint. Before joining TechPoint last year, Linder was an Indianapolis-based partner at Wisconsin-based investment firm and accelerator operator Gener8tor.

A focus on profitability

Zionsville-based 120Water, which earlier this month announced it had closed a $43 million round of funding, offers an example of what it takes to attract investors right now. The funding round was led by New Jersey-based Edison Partners. Local investor Allos Ventures, which has offices in both Carmel and Cincinnati, also participated in the round.

The firm, which launched in 2016, offers software to help water utilities manage data collection, testing, reporting and other aspects of water quality compliance. The company sees big opportunities ahead in programs like the U.S. Environmental Protection Agency’s proposed Lead and Copper Rule Improvements, which would require water systems to inventory their lead pipes by Oct. 16 and replace those pipes within 10 years.

Megan Glover, 120Water’s co-founder and CEO, said the company has had some profitable months to date and is on target to achieve consistent profitability starting next year. This fact, plus the company’s track record of success, helped it attract the $43 million investment, she said.

In regard to the venture funding market this year, Glover said, “I think there will be a ton of opportunity out there for businesses that either are profitable, or on the cusp of profitability, with an installed customer base.”

In the current market, investors affirm, profitability is more of a focus than it was during the boom times of late 2021 and early 2022.

“There’s been a big shift over the last, I’d say, 18 to 24 months,” said Allos Ventures Managing Director David Kerr. “There used to be a growth-at-all-costs mindset.”

Previously, Kerr said, investors wanted to see a company posting revenue growth of 100% or more. Now, he said, growth is still important, but investors are also paying attention to profitability. “If that company was growing at 60%, 70%, 80% but was profitable or very close to profitability, they’re going to be looked at very favorably.”

Carmel-based Ivy Ventures, which launched last year, made its first investment in November 2022 and has invested in six companies to date.

Ivy Ventures General Partner Scott Kraege agreed that the investing emphasis began to turn in mid-2022 toward careful growth.

Now, Kraege said, “companies need to focus on healthy growth, very thoughtful hiring, being very prescriptive with how they spend money.”

Kraege said he expects these conditions to continue in the year ahead. “I think, in general, we’re steady-state.”

An outlier

Not every investor hit the brakes in 2023.

For Indianapolis-based HG Ventures, the venture investing arm of The Heritage Group, 2023 was pretty much business as usual, said HG Ventures Senior Director Ginger Rothrock. “We did not slow down our funding of companies at all.”

HG Ventures made more than a dozen investments last year, Rothrock said. That figure includes four new investments and four follow-on investments into the firm’s existing portfolio companies, plus another five deals that were not announced publicly.

HG Ventures gets its funding from The Heritage Group, a privately held company that has a history of growing during down markets, she said.

That said, the firm has been advising its portfolio companies that fundraising might take twice as long as usual, Rothrock said, and that companies should approach twice as many potential investors as they might in better times.

(In the world of venture investing, it’s common for a company to secure investments from multiple sources in a single funding round—so the companies in which HG Ventures invests are likely seeking investments from other firms as well.)

Typically, Rothrock said, she has three ways she interacts with portfolio companies: cheering their successes, coaching them through difficulties or challenging them to achieve more.

Last year, she spent a lot more time as a coach and a cheerleader than she did as a challenger, she said. “I felt like we just needed to be more supportive of our entrepreneurs—because times were so challenging—versus pushing them to go faster, harder, do more.”

Positive signs

Looking ahead, there are some reasons for optimism.

Kerr, at Allos Ventures, said he feels hopeful about the fact that the public markets did so well last year, particularly toward the end of the year.

The S&P gained 24% last year, while the Nasdaq gained 43%.

Market trends typically show up first in publicly traded companies, then move to large privately held companies, then smaller companies.

The strength of public markets, Kerr said, leads him to believe mergers and acquisitions might increase in the first half of the year. Mergers and acquisitions are relevant to the venture market because these deals provide a payout to investors, who can then reinvest that money in other companies.

At Elevate Ventures, Day said he expects deal flow to continue at about the same pace as last year.

However, Elevate Ventures is taking a new approach to funding the state’s newest startups. Day said he’s excited about a newly formed $3 million preseed fund that will nearly double the amount Elevate Ventures can invest in early-stage companies.

Previously, the main way Elevate Ventures funded early-stage companies was through its Elevate Nexus Pitch Competition, which provided a little more than $1.6 million to startups around the state.

Elevate Ventures has retired that competition, Day said, and increased the pool of funding to $3 million. Another advantage of the new format, he said, is that Elevate Ventures can invest in early-stage startups at any time since the funding is no longer tied to a pitch competition. “Being able to make investments any day of the year—that’s really exciting.”