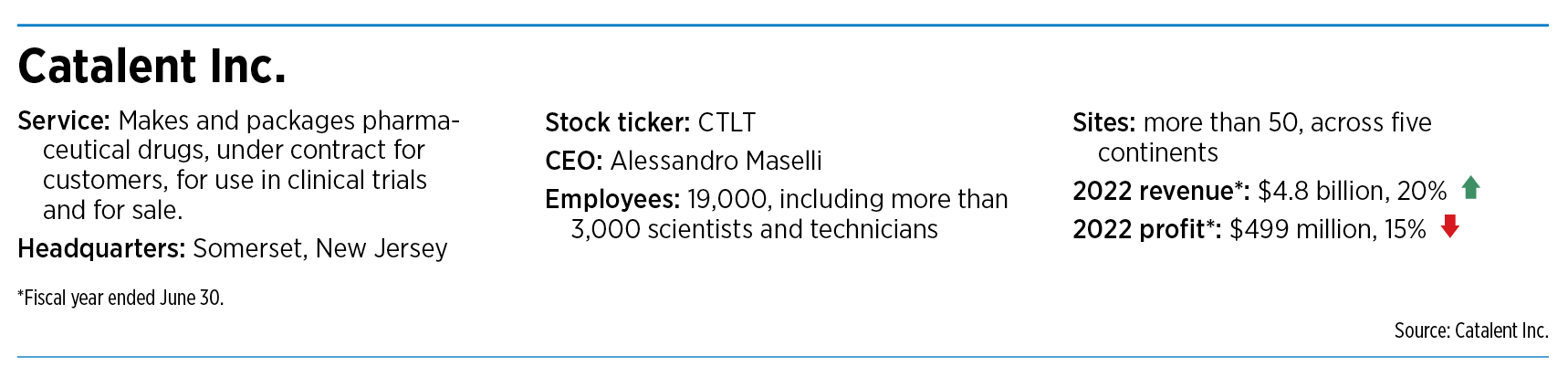

Contract drugmaker Catalent shrinks as pandemic wanes

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

BLOOMINGTON, Ind. - Just 14 months ago, Bloomington officials were ecstatic when contract drugmaker Catalent Inc. announced a huge plant expansion in their city.

The New Jersey-based company said it would invest $350 million in its Bloomington factory, formerly a shuttered television assembly plant, and would hire an additional 1,000 workers, paying an average of $32 an hour.

Catalent said the expansion would help serve the industry’s pipeline of developing biologic medicines, including antibodies, vaccines and gene therapies.

“We sincerely appreciate the chance to work with an employer of this caliber who is choosing this place to make the largest investment in technology, equipment and new jobs in our recent history,” Mayor John Hamilton said at the time.

The Greater Bloomington Chamber of Commerce called it a “historic win for the people of Bloomington and the entire region.”

But in a head-spinning turn of events, Catalent has since announced two large rounds of layoffs at the Bloomington plant—400 workers last December and 150 this month.

The company, which makes COVID-19 vaccines for Moderna and Johnson & Johnson, along with a range of other injectable medicines in syringes and vials, blamed the cutbacks on the sharp drop in demand for vaccines.

Drugmaker Pfizer Inc., another maker of COVID-19 vaccines, warned investors in January that it expected revenue to drop as much as a third this year as demand for the vaccine declined. In April, drugmaker Moderna said it expected a 90% reduction in demand this year for its COVID-19 vaccine.

But some companies, like Catalent, were slow to adjust.

“Unfortunately, we didn’t anticipate the unprecedented complexity involved in exiting the pandemic, both operationally and financially, and the difficulty of pivoting this site to non-COVID programs,” Anibal Carlo, vice president and general manager of the Bloomington plant, told employees in an internal email on June 1.

The company has said the plant—along with two others, in Maryland and Belgium—had serious productivity concerns and higher-than-expected costs.

Catalent did not respond to IBJ’s requests for comment.

The company’s about-face has caused hundreds of Catalent workers in Bloomington to lose high-paying jobs and has surprised officials who were expecting the company to keep growing there indefinitely. The company has also eliminated dozens of open positions.

The extra 1,000 jobs Catalent had planned to add would have generated an extra $466,000 per year in city income taxes, said Alex Crowley, Bloomington’s director of economic and sustainable development.

He said the pandemic’s slowdown has forced Catalent to take another look at all its operations and make adjustments.

“My understanding of the situation is that when the pandemic was going gangbusters, they were going crazy,” Crowley said. “They had to staff up really aggressively for pandemic-related and regular demand in the plant.”

He added: “So you are bringing people in. You’re not really paying attention to the efficiencies. It’s just kind of like, hair on fire, got to get butts in the seats and bodies on the line and get the product out the door.”

With all the quick hiring, training and quality seemed to be slipping. In September, inspectors from the U.S. Food and Drug Administration reported that they observed 179 instances of vials containing foreign matter, particulate matter, black specks and other impurities at the Bloomington plant.

The 19-page report pointed out poor maintenance of records and established laboratory controls.

Known in industry circles as a Form 483, the report followed a monthlong inspection of the Bloomington factory and required the company to bring the factory up to cleanliness standards, a process known as remediation.

IBJ sought to speak with Catalent officials about the FDA inspection and to ask whether the company was forced to shut down lines to correct deficiencies. But Catalent did not respond to multiple phone calls and emails from IBJ to its Bloomington plant and its headquarters in Somerset, New Jersey.

Financial questions

Catalent’s problems were mounting even as competitors were feeling an unprecedented boom in the contract drug manufacturing market.

“The market collectively now is probably as strong as it’s ever been,” said Cory Lewis, co-founder and CEO of INCOG Biopharma Services Inc., a contract drug manufacturer based in Fishers.

He said the industry is dealing with pent-up demand for contract manufacturing because COVID vaccines had taken up so much capacity for several years. He said drugmakers had been scrambling to manufacture batches of experimental drugs for clinical trials for other diseases.

Contract drug manufacturers act as a behind-the-scenes player in the sprawling pharmaceutical industry. They typically handle outsourcing from a wide variety of companies, from small biotechs testing new products to huge drugmakers needing additional manufacturing capacity.

The sector is projected to grow nearly 60% over seven years, from $98.7 billion in 2018 to $157.7 billion in 2025, according to Grand View Research, a market research firm based in San Francisco.

But while the market is booming, Catalent is plagued with difficulties. The company has repeatedly run into accounting and financial problems in Bloomington and other sites, which contributed to the company twice delaying its quarterly earnings last month before finally releasing them two weeks ago.

Catalent CEO Alessandro Maselli said then the company was forced to correct a $26 million revenue recognition error from last year relating to an unspecified “contract modification” of an unnamed Bloomington customer.

And that was just for starters. The company also recorded several accounting adjustments in the quarter, the largest of which were raw material write-offs and an increase to its inventory reserve of roughly $55 million related to certain raw materials and components in Bloomington.

Catalent also identified a material weakness in its internal financial controls related to its failure to detect the Bloomington errors. The company has made personnel changes “to ensure these issues are not repeated,” Maselli said.

“We continue to see productivity improvements in Bloomington and Brussels since our last update,” he told investors in a June 12 conference call. “Both sites are on the right path, but given the significant disruption from the remediation efforts and the COVID operational cliff, more work and time are needed before we return to our previous margin levels.”

Some analysts say they believe the worst is over but it’s too soon to know for sure.

“Management was clear that more work and time are needed to restore previous operational levels at each of these facilities,” William Blair analyst Max Smock wrote to clients in a June 13 note.

“Productivity won’t return to normal for several quarters, but management’s cost-cutting initiatives and operational enhancements are a start on the right track,” Jefferies analyst David Windley wrote in a note to clients on May 23.

Acquired from Cook

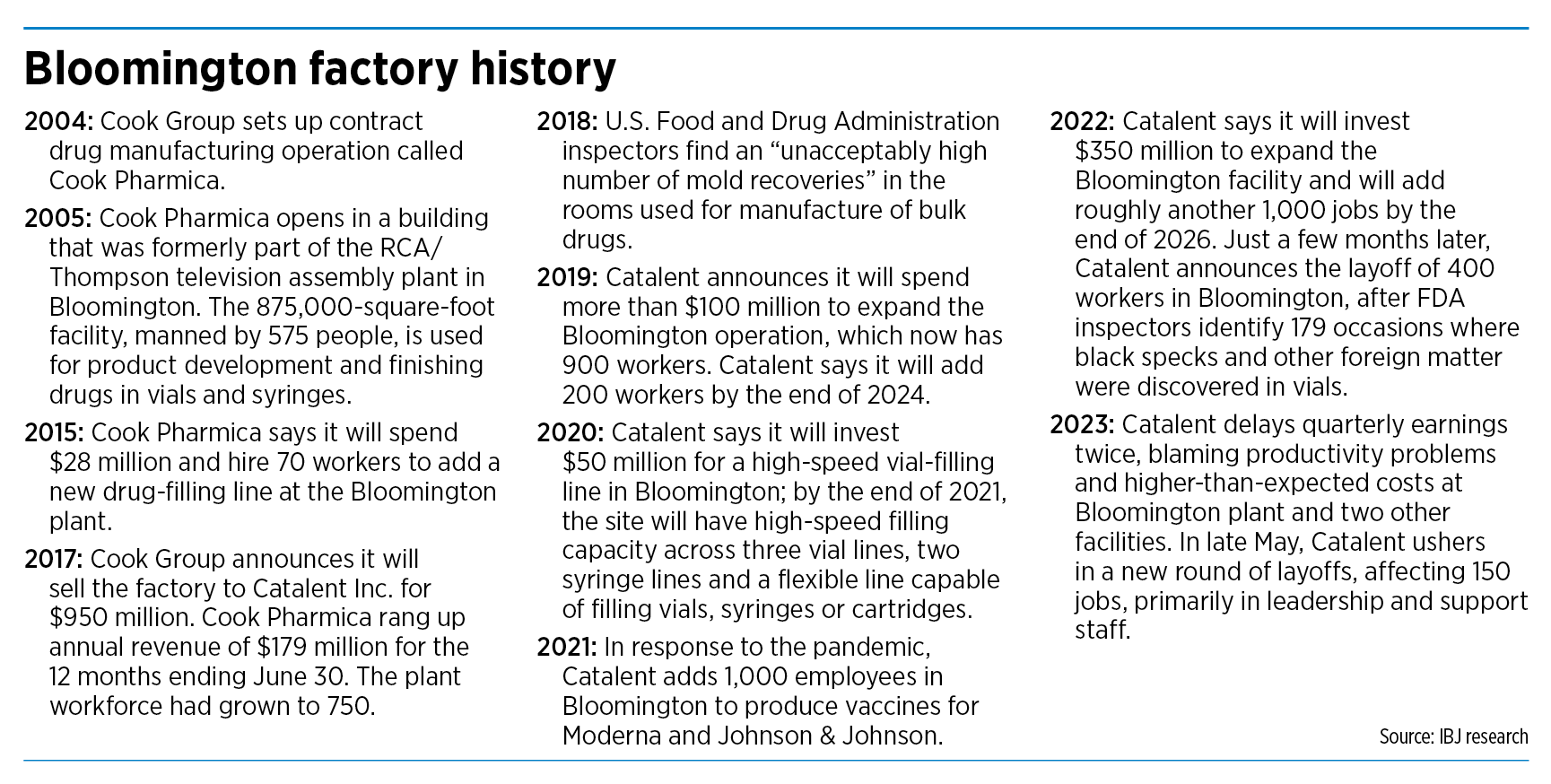

Catalent came to Bloomington when it acquired the operation from Cook Group in 2017 for $950 million.

Cook, the huge Bloomington-based medical-device company, had set up the contract drug manufacturing operation in 2004 as a way to diversify. It dubbed the new division Cook Pharmica, the Latin word for drug.

It opened the operation a year later in a building in Bloomington that had been the world’s largest television plant owned by RCA/Thompson Consumer Electronics. The TV assembly plant closed in 1998, ending a 58-year presence in Bloomington.

For 12 years, Cook Group ran the 875,000-square-foot plant, which employed as many as 750 workers at the time. The plant specialized in developing biologics-based drug compounds or products.

The contract drug manufacturing industry was growing, as drugmakers were outsourcing more of their development and manufacturing to cut costs.

“It was the wave of the future,” said Lewis, who served from 2009 to 2017 as vice president of business development and marketing for Cook Pharmica.

Cook finally sold the operation to Catalent, then one of the world’s largest contract drug manufacturers, as a way to get more capital to invest in new medical devices.

The deal was just the latest in the consolidating global contract manufacturing industry. In 2017, Thermo Fisher Scientific bought contract drugmaker Patheon for $7.2 billion, and Lonza bought capsule maker Capsugel for $5.5 billion.

Although Cook was a big player in devices, ringing up more than $2 billion in annual sales, it was a relatively small player in contract drug manufacturing. For the 12 months ending June 30, 2017, Cook Pharmica had sales of less than $180 million.

During the same period, Catalent garnered $2.1 billion in contract drug manufacturing sales. The much-larger company was eager to get ahold of the Cook facility and fold it into its global operation.

“Upon completion, Cook Pharmica’s over 750 associates, including its experienced executive team, will join Catalent’s network of more than 30 sites across five continents with more than 10,000 team members and complement Catalent’s existing biologics capabilities, alongside its other leading capabilities in oral, inhalation, and consumer health,” the two companies said in a joint statement on Sept. 19, 2017.

Hiring, laying off

For a few years, the operation appeared to run smoothly under new ownership. At least four times from 2019 to 2022, Catalent announced it was hiring more workers and investing more money in the plant.

Yet quality concerns cropped up. In 2018, an FDA inspection uncovered a high amount of mold at the site, along with other quality-control problems.

In 2021, in response to the pandemic, Catalent added 1,000 employees in Bloomington to produce vaccines for Moderna and Johnson & Johnson. Peak employment was about 2,900 during the pandemic, with the promise of more to come, Crowley said.

But instead, the company began chopping. The first round, last December, was largely hourly workers. The second round, earlier this month, was aimed primarily at leadership and support staff.

In May, as the company was delaying its quarterly earnings, it tried to reassure analysts that it was on the right track, pointing out that it was continuing to win business with the expansion of its contracts with drugmakers Novo Nordisk and Samsung Bioepis.

But some analysts were unconvinced, noting a weakness in the company’s pharmaceutical and consumer health markets along with ongoing productivity problems and accounting reviews.

JP Morgan analyst Julia Qin downgraded her rating on Catalent to “neutral” from “overweight” and lowered her price target on the stock from $90 to $45. (The company’s stock was trading this week in the $44 range.)

Hamilton, Bloomington’s mayor, was traveling this week and unable to comment, city officials said.

Crowley, the economic development director, said he was glad to see the company “right-sized,” even though it meant hundreds of people were losing their jobs.

“I’m actually kind of optimistic and appreciate the moves, because that puts them in a much more profitable, viable economic structure for the plant,” he said.•