Charitable care stagnant even as not-for-profit hospitals sue Hoosiers

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

Patrick Lopez couldn’t breathe. He had dealt with asthma since childhood, but this was different. He felt like he was drowning.

A doctor at Community Hospital in Munster confirmed it: His lungs were full of fluid, and he would need to be admitted for COVID-19 complications. Lopez spent a week in the intensive care unit.

“I was terrified for my life,” he recalled in an interview. “I knew I had to fight.”

It was 2020. Lopez had already lost his job as a maintenance mechanic and, in turn, his health insurance. But he focused on survival, knowing that financial assistance was available through the not-for-profit hospital.

Lopez found another job. He proposed to his girlfriend. They learned they were about to have a little girl.

Then he received a hospital bill for $40,000. He worked out a payment plan with Community but said he was unable to make the monthly minimum payments of $600 after another layoff.

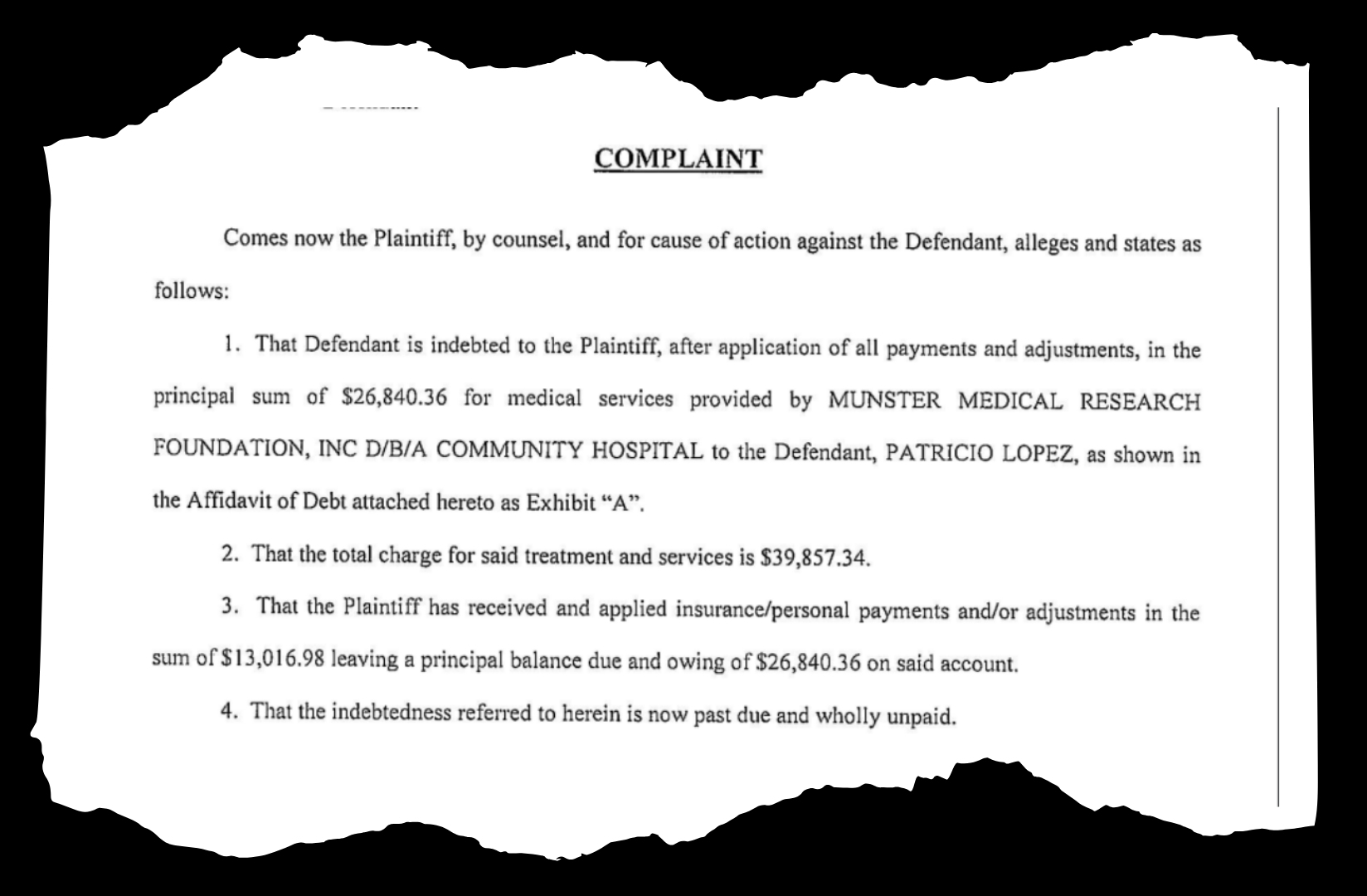

The hospital referred his account to Komyatte & Casbon, a local law firm specializing in debt collection. More than three years after his illness, the sheriff served Lopez with a lawsuit over the $27,000 remaining on his bill. Community Hospital was suing him.

Charitable care has not kept pace with revenue

Some of Indiana’s not-for-profit hospitals appear to have stalled when it comes to providing charitable care, though health care systems continue to send thousands of Hoosiers to court over unpaid sums as small as $250.

Analysis for this story reviewed court filings in 75 counties by 30 hospital systems, including Deaconess, Powers Health and Franciscan Alliance.

Federal and state regulators alike have scrutinized not-for-profit hospitals’ financial practices and struggled to define how much benefit they should provide — even as hospitals reap profits.

Over the last decade, not-for-profit hospital revenue has increased while spending on free and discounted care has remained stagnant, according to government data aggregated by the National Academy for State Health Policy.

In 2012 in Indiana, about three cents of every revenue dollar went back into charity care. By 2022 — the most recent year for which data is available — that figure had dropped to 1.5 cents per dollar.

Under federal law, not-for-profit hospitals can engage in “extraordinary collection actions,” like suing patients, reporting to credit bureaus and denying medical care.

“It’s their money, and they’re going to figure out a way to get it,” said Diana Bauer, a Fort Wayne lawyer who works with clients in a debt recovery program.

The proportion of money spent on charity care dropped sharply in 2015, when more Hoosiers became eligible for Medicaid under the Affordable Care Act. Medicaid expansion, otherwise known as the Healthy Indiana Plan, may have reduced the need for charitable care.

Hospitals are also footing the bill for that plan via a hospital assessment fee.

Most hospitals spent more money treating Medicaid patients in 2022 compared to 2011 according to NASHP, though the program’s impact on hospitals’ budgets varied widely across health systems.

The Indiana Hospital Association (IHA) called medical debt a “critical issue” but said inadequate health coverage and uninsured patients contributed to the problem.

“While certain types of health insurance plans may appeal to consumers because they appear to be more affordable, they often come with significantly higher out-of-pocket costs and fewer benefits,” said Natalie Russell, the communications manager with IHA. “Indiana hospitals are strong advocates for comprehensive health care coverage and pay $1.5 billion annually to fund Medicaid and expand coverage under the HIP 2.0 program so more Hoosiers have access to care at a price they can afford.”

Russell shared an analysis from Kaufman Hall that found charitable care across all Indiana hospitals increased by 22% from 2022 to 2023. The methodology referenced in that study was based on a sample of “more than 52” hospitals’ data, and the figures appear to differ significantly from federal and publicly available data.

Chad Bills, the vice president of revenue cycle at Community Health Network, added that hospitals also saw more patients find coverage under the Affordable Care Act’s Marketplace plans. CHN is not affiliated with Community Hospital in Munster, which is operated by Powers Health.

“The other thing that health care systems were forced to do is put programs in place from a navigator perspective, or an eligibility enrollment perspective — to spend dollars to help patients find coverage,” Bills said.

Financial aid could help Medicaid-ineligible patients who are unable to afford care.

Charity care criteria vary by hospital. Nineteen states require hospitals to provide assistance to patients below a certain income threshold. Indiana is not one of them.

Lopez, the maintenance mechanic who was hospitalized for COVID, said he was denied financial assistance. He’s the sole earner for his family and he makes about $70,000 per year.

That’s in line with Community Hospital’s policy, which in 2021 capped subsidized health services at an annual income of $65,160 for a family of three.

Powers Health, the hospital’s parent organization, did not respond to multiple requests for comment.

While one not-for-profit health system filed at least 10,000 debt lawsuits over the last five years, other hospital chains in Indiana say they are changing their charitable care and collections processes.

In December 2022, IU Health stopped taking patients to court over medical bills, according to public relations manager Lisa Tellus. A representative for Ascension St. Vincent said that the hospital’s policy does not engage in extraordinary collection actions except in extremely rare cases, and that it has not done so once in the past year.

Bills, the Community Health Network administrator, said his hospital system is actively trying to increase charity care spending.

“The number one opportunity that we have – and we constantly look at this, all the time – is how do we market that program and encourage patients to apply?” Bills said.

The court process

Samantha, a Lake County kindergarten teacher who asked to be identified only by her first name, dealt with health complications when she had a baby.

After a handful of prenatal appointments, a bout with pre-eclampsia, and a baby with a kidney infection, Samantha said the constant medical bills were indistinguishable.

She set up a payment plan with the hospital, which she assumed would pay down the balance on all of the bills. But she was wrong – her payments only put money toward bills that were processed before the payment plan became active.

“I didn’t know anything until the sheriff showed up at my door,” Samantha said.

She’s now paying the law firm handling her debt a minimum $37 per month. She said she’s also sending another $80 to the hospital each month to prevent more bills from turning into lawsuits.

Judgements can require losing defendants to pay legal fees and court costs, mitigating the financial risk hospitals took by suing patients. Initial intake forms included with filings show patients agreed to pay those fees as a condition of receiving medical treatment.

These fees can make medical debt substantially more burdensome.

State law sets interest on the total balance of the debt at 8% per year, which can further increase the amount owed.

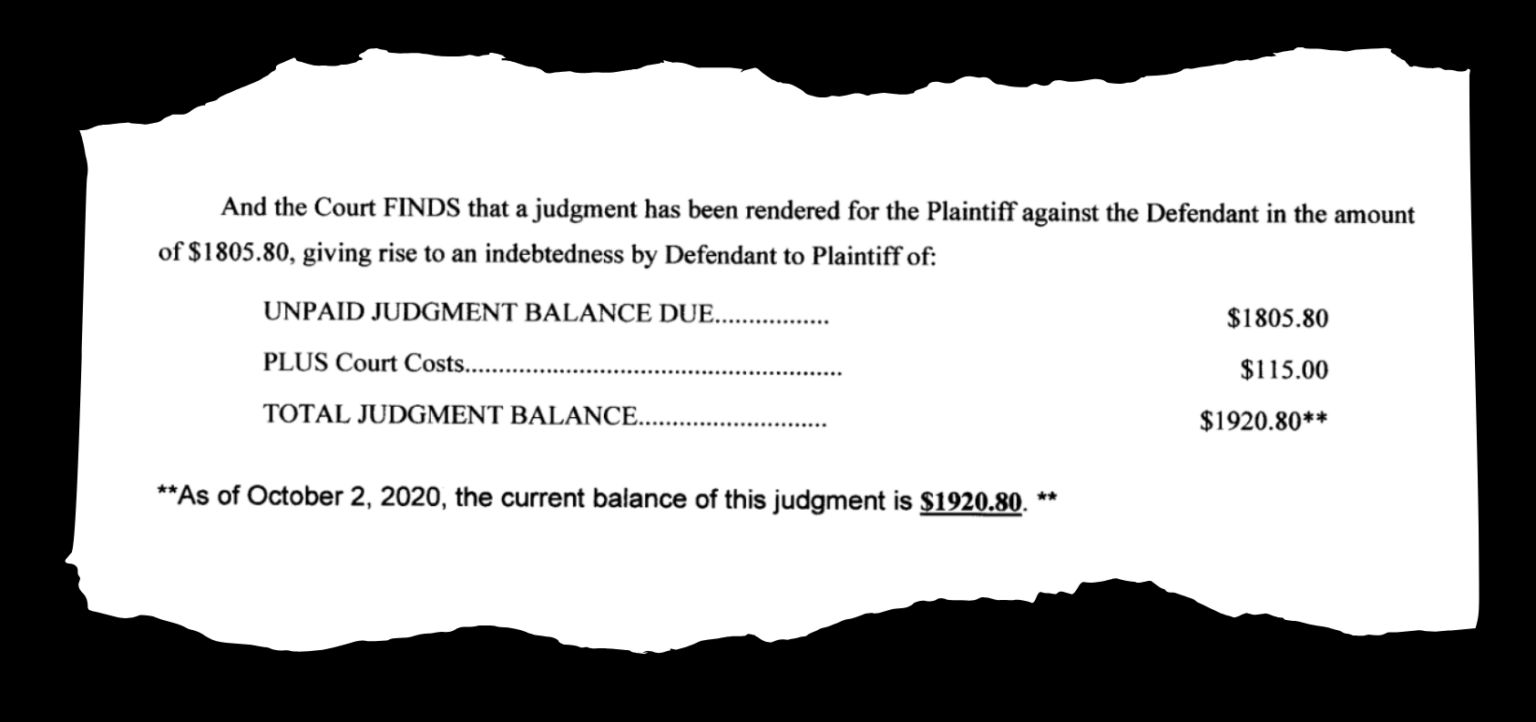

An Evansville woman received a judgment of $1,805.80 for medical bills and attorneys’ fees. By the time the plaintiff filed a wage garnishment order, interest had increased that amount by more than $100.

Court records reveal that defendants often miss hearings, resulting in default judgments against them.

“Most of them [defendants] don’t show at all, and most of them don’t have representation,” said Tim Fesko, an attorney who represents Powers Health in court, Community Hospital’s parent organization, in some medical debt cases.

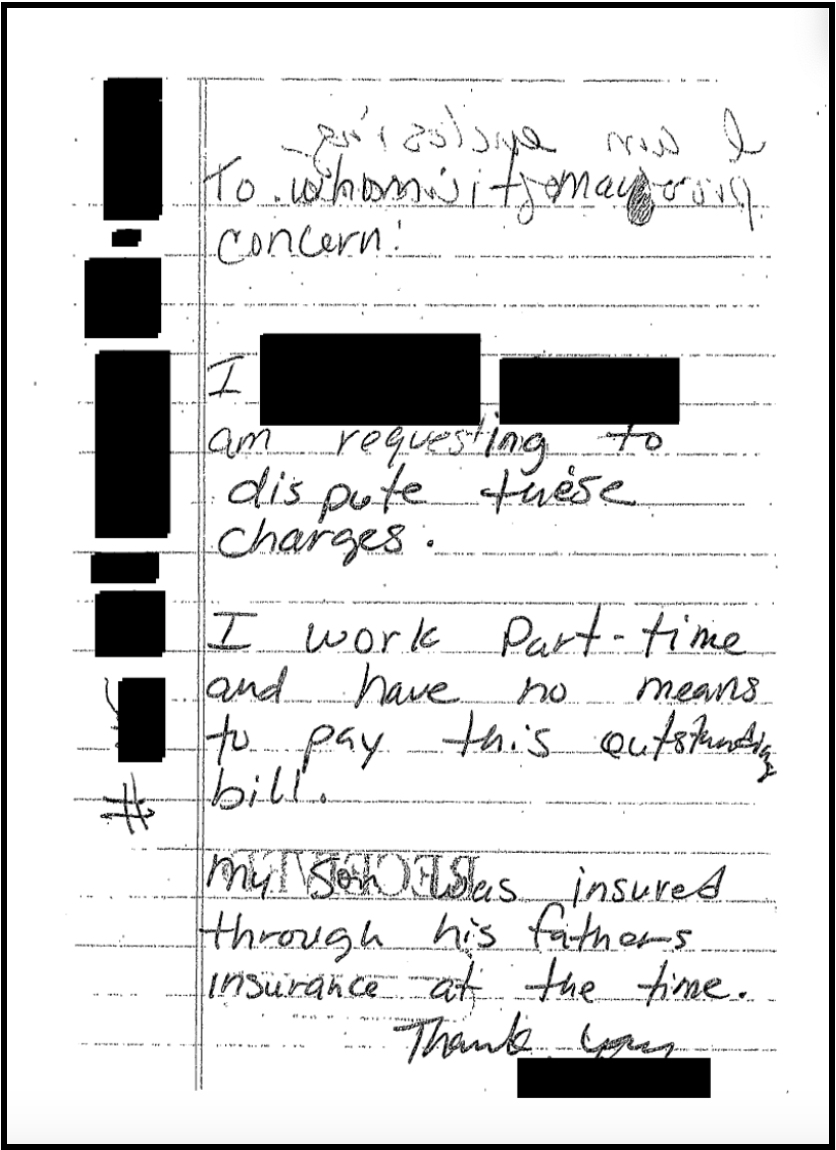

Some patients’ court documents reveal a lack of legal knowledge.

One woman tried to file an answer with the court disputing a debt. Instead, she sent it to the lawyer handling the hospital’s case. The judge found her and her husband in default.

When defendants lose lawsuits but don’t have the money to pay their debts in full, the hospitals or their law firms may allow them to enter payment plans.

If a defendant enters a payment plan but is unable to keep up with it, they may find themselves back in front of a judge.

The court can then move to garnish a defendant’s wages. Indiana law allows creditors to collect up to 25% of a debtor’s net income.

Wage garnishment orders can drag cases out for years. An Evansville couple sued in December 2019 didn’t resolve their case until January 2024.

Some patients end up in court even though they have the cash to cover their bills. Defendants say that they never received a bill or that their insurance was billed incorrectly.

Unlike cases that go through collections agencies, civil court judgments like Samantha’s are not reported to credit bureaus. Instead, the case becomes a matter of public record, which could still affect her ability to access credit.

Samantha said that having a court case associated with her name was as troubling as a mark on her credit report.

Hospitals can’t pursue collections cases against patients until they’ve made “reasonable efforts” to screen for financial need, but in 2022 the CFPB reported that not all patients eligible for financial aid receive it.

“It’s embarrassing,” Samantha said.

Reasonable efforts

Samantha, the kindergarten teacher, said she was never given information about applying for assistance at Community Hospital in Hammond.

Per the IRS, not-for-profit hospitals are required to notify patients of their financial assistance policies before initiating a collections case.

Financial assistance applications can be burdensome. They often require tax returns going back several years, hard copies of monthly bank statements and an estimated monthly budget breakdown.

When assistance agencies closed to the public during the COVID-19 pandemic, Darlene Jennings could not gather the necessary documents for her financial assistance application. The 73-year-old does not own a computer or printer.

Jennings worked at the time as a dietary aide at Community Hospital in Munster and became ill during her shift. Her coworkers took her downstairs to the emergency room.

The bill came to $12,000. Jennings was between insurers at the time.

After the incident, she worked part-time at the hospital for another five years. She paid off the bill in $45 increments each month.

“When you’re on a fixed income, you know, that’s all you can squeeze out. Forty-five dollars,” Jennings said.

Two months after she retired from her job, she missed a payment. She caught up the next month by sending a double payment and “a nice little letter telling [them] I was sorry.”

But the hospital sued her for the remaining balance. She took a job at a school cafeteria to supplement her Social Security income.

A legal aid attorney helped Jennings come to an agreement to pay $5,000. She sent a cashier’s check out. “And that was it. I haven’t heard a word out of them,” she said.

Mounting pressure on not-for-profit hospitals

Not-for-profit hospitals are tax exempt to recognize the benefit the businesses provide to communities. Regulators and watchdogs have struggled to quantify that benefit.

In 2012, the IRS proposed a rule that would require hospitals to be more proactive in determining eligibility for financial assistance.

The proposal was met with hundreds of opposing comments from debt collectors and not-for-profit hospitals, including Franciscan Alliance and IU Health. The IRS did not implement the rule.

Even when patients do qualify for financial assistance, the policy might not cover all hospital bills. IU Health’s policy, for example, applies only to “qualifying care” — preventive care or non-urgent treatments may not qualify.

Helen Colby, an IU economist who studies how people make health care decisions, said that restrictive policies like these can come as a surprise to patients.

“I do think that consumers have very different expectations about behavior from for-profit and not-for-profit entities,” Colby said. “And in the health care space, that’s probably exacerbated.”

While the Affordable Care Act requires not-for-profit hospitals to maintain a written financial assistance policy, there are no federal rules about the proportion of revenue hospitals should dedicate to charity care or who should qualify.

Those rules are decided on a state level, and Indiana has not implemented any laws to regulate charity care.

The IRS describes six factors that hospitals should meet in order to demonstrate “community benefit” and maintain tax-exempt status. Financial assistance is not one of them.

Even if a hospital doesn’t meet all six criteria, the IRS may still determine that a hospital provides sufficient community benefit.

There is no limit on how much excess revenue a not-for-profit can bring in on an annual basis. Lawmakers, economists and healthcare advocates have questioned whether not-for-profit hospitals receive tax breaks on par with the benefit they provide.

According to a 2020 Government Accountability Office report, 48 hospitals throughout the country spent nothing on charity care in 2016, Thirty spent nothing whatsoever on any community benefits, like research or education.

The report doesn’t specify where these hospitals were located. None of them had their tax-exempt status revoked by the IRS.

The GAO recommended that Congress clarify what constitutes “sufficient” community benefit, but the suggestion has yet to be implemented.

One day before the GAO published its report, Indiana’s Fifth District Republican Rep. Victoria Spartz introduced a bill that would establish a nationwide minimum level for community benefit. It died in committee.

In August 2023, Sen. Chuck Grassley (R-Iowa) and Sen. Elizabeth Warren (D-Mass) wrote a letter to the commissioner of the IRS encouraging stronger scrutiny of not-for-profit hospitals.

“We are alarmed by reports that despite their tax-exempt status, certain not-for-profit hospitals may be taking advantage of this overly broad definition of ‘community benefit’ and engaging in practices that are not in the best interest of the patient,” the letter read in part.

At an October conference, an IRS official said not-for-profit hospital’s community benefit provision would become an enforcement priority, according to Bloomberg Tax.

Statewide efforts

Indiana legislators have tried to reform the state’s health care costs with varying success.

In January 2023, Rep. Donna Schaibley (R-Carmel) authored a bill – House Bill 1004 – that would fine not-for-profit hospitals if their prices were above 260% of the Medicaid reimbursement rate. Hospitals rallied against the bill, disputing an oft-cited RAND Corp. claim that the state’s hospitals charged an average of 300% of the Medicaid reimbursement rate.

Instead, the health systems called for free market solutions, as documented in a Star Press column.

The piece read: “The market is working, and we should let it continue in the most consumer- and business-friendly manner possible. Government interventions, such as statutory price setting, will not accomplish this goal.”

Three weeks after the op-ed was released, Gov. Eric Holcomb signed a significantly weakened version of HB1004 into law without a penalty provision. Instead, it establishes a state health care cost oversight task force and requires some nonprofit hospitals to hire a third party to study pricing.

Lopez, the maintenance mechanic who was hospitalized with COVID, said he chose Community Hospital because the first one had a significantly longer wait time.

In a March interview, Lopez said he was trying to come to an agreement with the law firm handling his case. They were having trouble agreeing on a number that would work for everyone.

“I’ve been extremely stressed out about it,” he said. “Because now, I have to come up with a couple thousand [dollars] to give their attorney so that my wages don’t get garnished. That way, I can make sure I can buy diapers and formula for my daughter.”

On Wednesday, the court entered a judgment against Lopez for just over $26,800.

“To this day, I still feel like I have some kind of PTSD from catching COVID,” Lopez said. “If just by some chance I get winded, or I’m running, or I’m at work, I start to get anxiety.”

He said the collections case has made him reluctant to seek medical attention.

“Ever since getting a $30,000 bill …,” Lopez said, trailing off mid-sentence.

“The people that caught this money,” Lopez continued, referencing the law firm that pursued the case against him. “They don’t care. They don’t care.”

Komyatte & Casbon declined to comment for this story.