Carmel-based MBX Biosciences shares jump 48% in Nasdaq debut

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

Carmel-based MBX Biosciences Inc. saw it shares jump nearly 48% in its debut Friday on the Nasdaq.

The five-year-old company is developing treatments for endocrine and metabolic disorders, such as hypoparathyroidism, post-bariatric hypoglycemia and obesity. Its positive reception on Wall Street was seen as an extension of the general enthusiasm for obesity treatments.

MBX said on Thursday it raised $163.2 million by selling 10.2 million shares at $16 each in its initial public offering. The company’s shares opened on the market Friday at $23 each and closed at $23.65.

The company said it planned to use the proceeds from the IPO to advance the development of its drug candidates, including MBX 2019 into Phase 3 clinical testing and MBX 1416 into Phase 2 testing. It also wants to advance a third experimental drug, MBX 4291, from preclinical development to clinical testing.

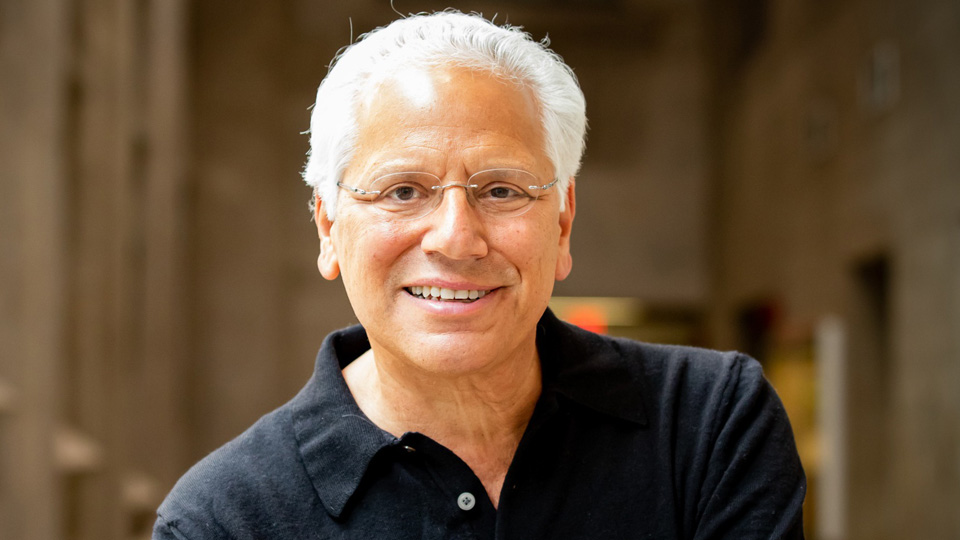

MBX was founded in 2019 by Indiana University chemistry researcher and serial entrepreneur Richard DiMarchi and his longtime partner, Kent Hawryluk, the company president and CEO.

DiMarchi, the company’s scientific co-founder, is no longer on the board of directors, but serves as an external advisor through a continuing research agreement between the company and his IU-Bloomington laboratory.

DiMarchi and Hawryluk worked together on two previous Indiana startups, Marcadia Biotech and MB2, which developed technology for metabolic diseases such as diabetes and obesity.

Marcardia was later bought by Swiss pharmaceutical giant Roche. Denmark-based Novo Nordisk later bought MB2.

DiMarchi has set up at least five companies since retiring from Indianapolis-based Eli Lilly and Co. in 2003 as group vice president for biotechnology research and product development. He has more than 100 patents and has published more than 150 scientific papers.

His other startups include Ambryx, Assembly Biosciences and Calibrium. All of the startups were sold, reaping more than $500 million for founders and investors.