Democratic opponent criticizes potential impact of Braun’s property tax relief plan

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

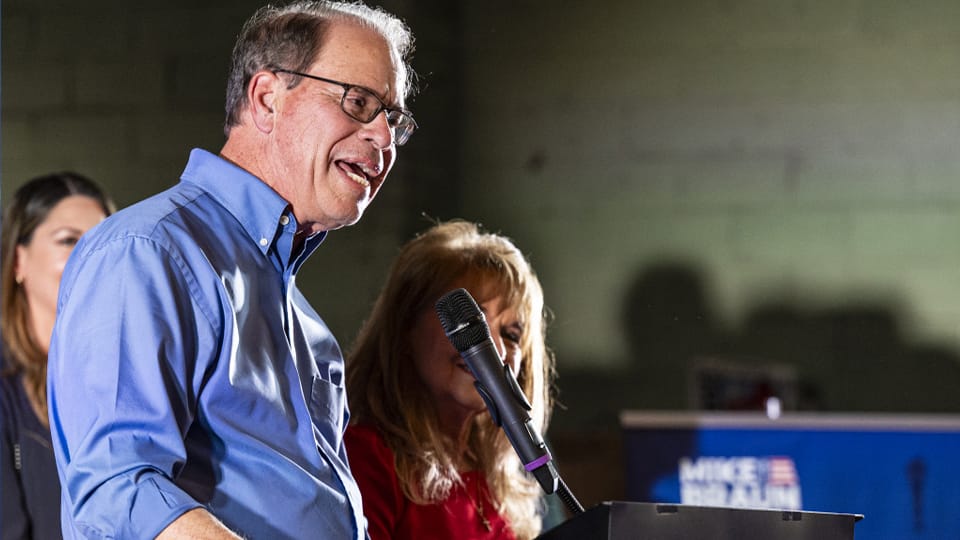

Sen. Mike Braun, the Republican candidate for governor, released his plan to control property taxes on Friday, calling for increasing the homestead deduction, capping property tax increases and increasing voter participation in property tax referendums.

“Nothing is more important than ensuring Hoosiers can afford to live in their homes without being overburdened by rising property taxes driven by rapid inflation in home values,” Braun said in written remarks. “My commitment to this agenda stems from my dedication to protecting the financial stability and well-being of Hoosier families.”

Under the plan, Hoosiers with an assessed home value over $125,000 could deduct 60% of their home’s assessed value for property tax purposes through a homestead deduction. Homeowners with an assessed value under $125,000 could use the 60% deduction, plus the current standard deduction of $48,000.

Braun’s campaign said these reductions would result in a 21% cut in the average homeowners’ tax bills, with more savings for homes with lower assessed values. For example, a homeowner with a home of an assessed value of $80,000 would see a 39% reduction in their tax bill on average.

Braun’s Democrat challenger Jennifer McCormick called his tax plan “irresponsible,” saying it would result in cuts to local government services.

“We have to be realistic,” McCormick told IBJ. “My biggest concern is we already have a revenue shortfall, and we’re also looking at services that are tied to his plan would be impacted significantly.”

It was not immediately known how deeply Braun’s proposal would impact local governments, but organizations representing county governments and local schools feared it could be dramatic.

Braun seemed to anticipate some those criticisms in an interview Friday morning with WIBC, saying: “Government at the local level should never grow faster than the ability of a taxpayer to pay for it.”

Braun also wants to cap property tax bill increases to 2% for seniors, low-income Hoosiers and families with children under 18. Tax bill increases would be capped at 3% for everyone else. Any property tax increases over the cap would require a referendum.

Braun’s proposal also would bring more scrutiny to property tax hike referendums. If Braun’s plan in enacted, referendums would be required to be on the ballot only during general elections, when there is a higher voter turnout. The proposals would also be required to include a total levy and data on the impact of the median taxpayer’s bill.

Interest groups representing local schools and county government expressed concern with Braun’s proposal, specifically with the lack of a revenue replacement plan for the local services the tax cuts would impact.

Scott Bowling, executive director of the Indiana Association of School Business Officials, said he has major issues with property tax cuts and caps. The impact could be dramatic on schools, he said, specifically on operational costs for busing, maintenance and utilities.

“Even at this early stage, when we look at it, there’s no way to get around the fact that doing this would have a negative impact on funding for schools,” he said.

David Bottorff, executive director of the Association of Indiana Counties, said he’s concerned about revenue reduction and is left with several questions. One of which is whether the 2% cap applies to all seniors regardless of income level.

“Asking us to further reduce our new revenues is going to create challenges and potentially a reduction in services,” he said.

Often, counties are tied to mandates that dictate their spending, Bottorff said. The application of this tax plan could make it even more difficult to meet mandates handed down by the state Legislature.

“We’re going to have to urge the General Assembly to look at some of the unfunded mandates they hand down, if they’re going to ask us to reduce spending,” Bottorff said.

Changes in property tax policy would need approval from the Legislature.