Auto workers stop expanding strikes after GM battery plant concession

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

The United Auto Workers union said Friday it will not expand its strikes against Detroit’s three automakers after General Motors made a breakthrough concession on unionizing electric vehicle battery plants.

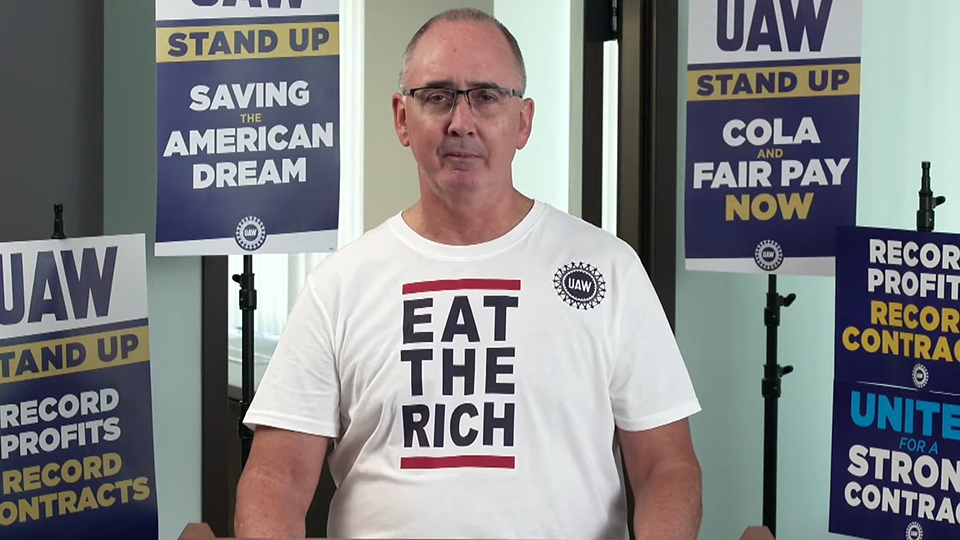

Union President Shawn Fain told workers in a video appearance that additional plants could be added to the strikes later.

The announcement of the pause in expanding the strikes came shortly after GM agreed to bring electric vehicle battery plants into the UAW’s national contract, essentially assuring that they will be unionized.

Fain, wearing a T-shirt that said “Eat the Rich” in bold letters, said GM’s move will change the future of the union and the auto industry.

He said GM made the change after the union threatened to strike at a plant in Arlington, Texas, that makes highly profitable large SUVs.

“Today, under the threat of a major financial hit, they leapfrogged the pack in terms of a just transition” from combustion engines to electric vehicles, he said. “Our strike is working, but we’re not there yet.”

In addition to large general pay raises, cost of living pay, restoration of pensions for new hires and other items, the union wanted to represent 10 battery factories proposed by the companies.

The companies have said the plants, mostly joint ventures with South Korean battery makers, had to be bargained separately.

Friday’s change means the four U.S. GM battery plants would now be covered under the union’s master agreement and GM would bargain with the union’ “which I think is a monumental development,” said Marick Masters, a business professor at Wayne State University in Detroit.

He said the details of GM’s offer, made in writing, will have to be scrutinized.

“GM went far beyond and gave them this,” Masters said. “And I think GM is thinking they may get something in return for this on the economic items.”

GM is currently planning a $3 billion EV battery plant in the northern Indiana town of New Carlisle as part of a joint venture with South Korea-based Samsung SDI. The project is expected to create 1,700 jobs.

Samsung SDI is also in a joint venture with Stellantis that is currently building a $2.5 billion EV battery facility in Kokomo, which is expected to create 1,400 jobs.

GM, Ford and Stellantis declined immediate comment on Fain’s announcement.

Shares of all three automakers rose after Fain’s announcement in apparent anticipation that deals might be near. GM’s shares ended Friday up almost 2%, Stellantis added 3% and Ford rose just under 1%.

The automakers have resisted bringing battery plants into the national UAW contracts, contending the union can’t represent workers who haven’t been hired yet. They also say joint venture partners must be involved in the talks.

They also fear that big union contracts could drive up the prices of their electric vehicles, making them more expensive than Tesla and other nonunion competitors.

For the past two weeks the union has expanded strikes that began on Sept. 15 when the UAW targeted one assembly plant from each of the three automakers.

That spread to 38 parts-distribution centers run by GM and Stellantis, maker of Jeeps and Ram pickups. Ford was spared from that expansion because talks with the union were progressing then.

Last week the union added a GM crossover SUV plant in Lansing, Michigan, and a Ford SUV factory in Chicago but spared Stellantis from additional strikes due to progress in talks.

Automakers have long said they are willing to give raises, but they fear that a costly contract will make their vehicles more expensive than those built at nonunion U.S. plants run by foreign corporations.

The union insists that labor expenses are only 4% to 5% of the cost of a vehicle, and that the companies are making billions in profits and can afford big raises.

The union had structured its walkouts so the companies can keep making big pickup trucks and SUVs, their top-selling and most profitable vehicles. Previously it shut down assembly plants in Missouri, Ohio and Michigan that make midsize pickups, commercial vans and midsize SUVs, which aren’t as profitable as larger vehicles.

In the past, the union picked one company as a potential strike target and reached a contract agreement with that company to be the pattern for the others.

But this year, Fain introduced a novel strategy of targeting a limited number of facilities at all three automakers.

About 25,000, or about 17%, of the union’s 146,000 workers at the three automakers are now on strike.