Applications to open for film incentives

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

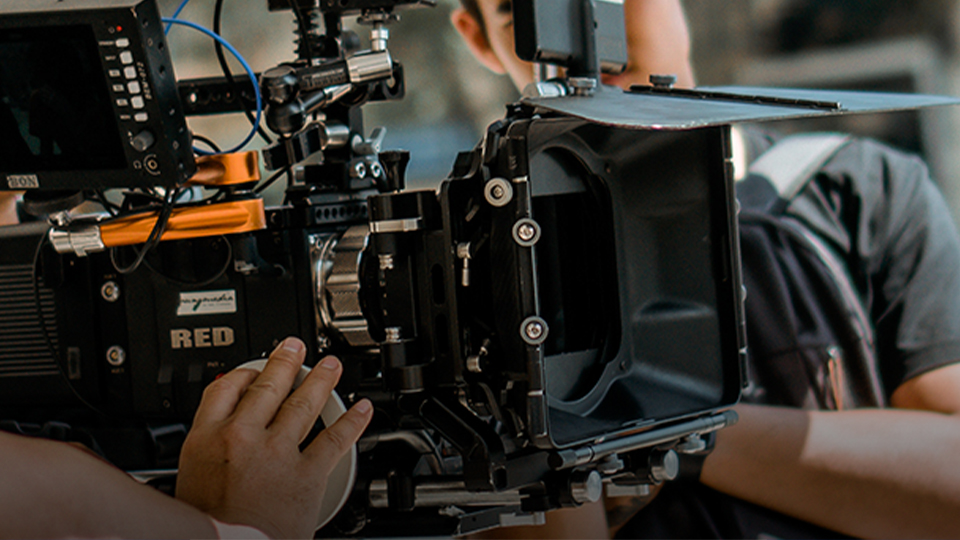

The Indiana Economic Development Corp. announced Tuesday applications will open this week for the new Film and Media Tax Credit. The incentive offers an income tax credit of up to 30% to help offset certain production expenses.

The tax credit was approved during this year’s legislative session as part of Senate Enrolled Act 361.

The IEDC says the incentive is designed to attract “qualified media productions” in Indiana and encourages student, amateur and professional crews to leverage Indiana’s urban, rural and natural assets.

Eligible productions could include film, television, music, or digital media.

“Creativity is an essential ingredient to the vibrancy of any community, and this new tool will encourage artists to do their work here in the Hoosier state,” Indiana Secretary of Commerce Brad Chambers said in written remarks. “By attracting media companies and their service businesses to Indiana, and by extension, continuing to diversify Indiana’s economic portfolio, it is my hope that we are enabling more of our talented young people to pursue careers that align with their passion, without having to leave home.”

The incentive includes up to 20% for qualified production expenses, including acquisitions, filming and sound, labor and story rights; up to 5% for having at least 20% of the overall workforce based in Indiana during pre- and post-production; and up to 5% for adding an IEDC-approved Indiana brand to the production’s credits.

In a March interview with Inside INdiana Business, State Representative Bob Morris (R-Fort Wayne) said having a 30% tax credit puts Indiana on par with the likes of New Mexico, Georgia, North Carolina and Kentucky, which offer similar incentives.

Morris said he was able to convince his colleagues in the Statehouse that Indiana needed this type of incentive.

“One thing that really inspired a number of members in the General Assembly was when I questioned them why we were offering film classes and media classes at our universities, when 98% of these students left the great state of Indiana and went to another state to work,” he said. “As I worked worked on this and talking with members in the House as well as the Senate just to look at the many universities from Huntington University to Taylor University to Ball State to Evansville and Indiana University that is up like 100% with their film students.”

Producers can apply for the tax credit beginning Friday through October 31. You can learn more about the incentive and application process by clicking here.