Indiana Farmer Testifies on Carbon Credit Legislation

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowIndiana farmer Brent Bible testified Wednesday before the U.S. Senate Agriculture Committee on proposed legislation that would make it easier for farmers to generate revenue by adopting conservation practices and earning carbon credits that can be sold in the marketplace.

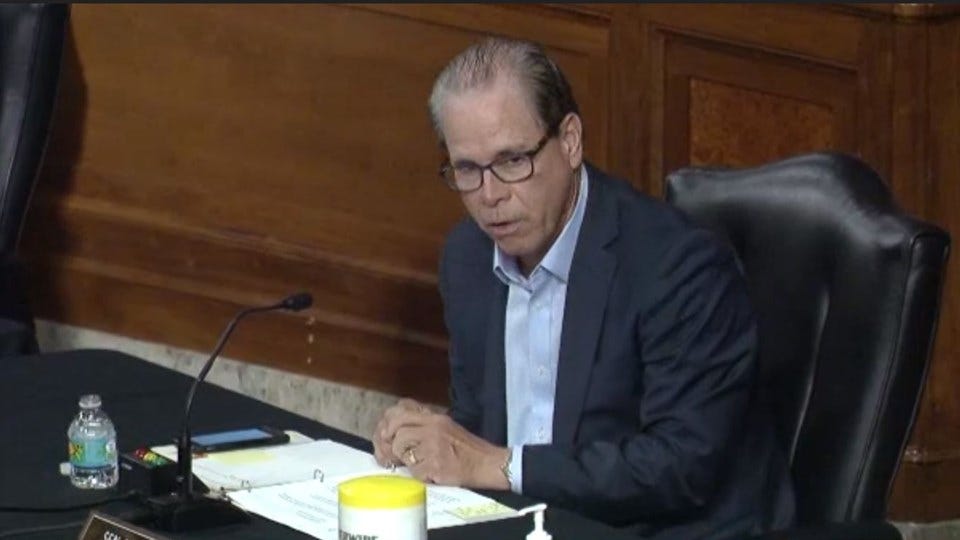

A bipartisan group of U.S. senators, including Sen. Mike Braun (R-IN) introduced three weeks ago the Growing Climate Solutions Act, which would break down barriers for farmers, foresters and landowners interested in participating in carbon markets.

“If we want to address our changing climate then we need to facilitate real solutions that our farmers, environmentalists and industry can all support, which this bill accomplishes,” said Braun, who introduced Bible during the committee hearing.

The bill would reward farmers to reduce greenhouse gas emissions by reducing tillage, improving nutrient management, and using less fertilizer. Bible said there would incentives for livestock producers as well.

“If there is an incentive there to capture that carbon. And if that market sends that the right economic signal, then farmers will respond to that,” said Bible, in an interview with Inside INdiana Business.

Bible, who farms 5,000 acres of mostly corn and soybeans in Lafayette, uses no-till and minimum till practices on some of his acreage, which reduces soil erosion and keeps more nutrients in the soil. But he also uses maximum tillage when the land requires it.

He’s also a farm advisor for the Environmental Defense Fund, which supports the bill.

“It’s a combination of what is the environmentally right thing to do and what is a sustainable practice from an economic perspective for our farm. And when we can mix those two together and come out with a good outcome, then we felt that we’ve done something right,” said Bible.

Carbon markets already exist, but the legislation would direct the U.S. Department of Agriculture to create a program to provide “transparency, legitimacy and informal endorsement of third-party verifiers and technical service providers to help farmers take part in the carbon market,” as described in the bill.

“I don’t think farmers, and I include myself, have a really good grasp on how the market can be beneficial. There’s not a lot of knowledge out there and not a lot trust in a carbon credit market to date,” said Bible. “That’s a distinction of what this bill does by bringing the USDA into the certification process and to provide legitimacy to the market.”

Bible earned an agriculture economy degree from Purdue University. He says while he has a passion for doing positive things for the environment, implementing changes on the farm must be sustainable both on the land and on the bottom line.

“A farm is not sustainable if it’s not profitable. If I want to be in business 20 years from now, 40 years from now, then I have to do things on the farm today that are going to sustain that farm, both economically and environmentally.”

Bible said the additional revenue farmers could earn would be about $10-$15 per acre on carbon credits. He said when farmers earn profits of $100-$120 per acre, it may not seem like a significant amount.

“Does $10 more really incentivize you to change practices? Probably not. But when you’re operating today at breakeven or at a loss, then if you can find another $10 an acre then that’s going to be something that I think a lot of producers will look at.”

Bible told lawmakers farming has been especially challenging the past two years with trade wars, supply chain disruptions and extreme weather events.

“To better withstand these external shocks, farmers need additional economic opportunities and greater adoption of practices that make our farms and agriculture as a whole more resilient.”

Brent Bible tells Inside INdiana Business his decisions are based on a balance of sustainability of the land and the bottom line.