Innkeeper’s Tax Debate in Allen County

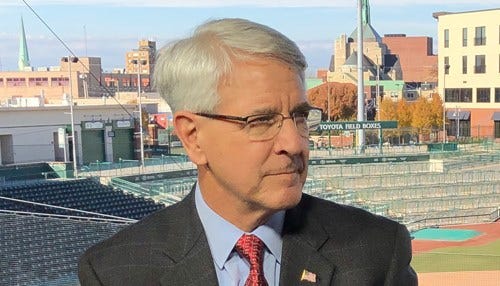

John Sampson is president and CEO of the Northeast Indiana Regional Partnership.

John Sampson is president and CEO of the Northeast Indiana Regional Partnership.

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowA tax to support the Fort Wayne and Allen County hospitality industry is facing opposition. But John Sampson, chief executive officer of the Northeast Indiana Regional Partnership, feels the so-called “Innkeeper’s Tax” is critical to economic growth for the region by using the tax revenue to market the communities to visitors.

“That firsthand experience is most often required by future residents. They have this positive image of a place they visited the experience that they had, going to a park or going to a zoo or going to a show or spending a night,” said Sampson. “And if we don’t showcase those, it doesn’t lay the groundwork for our future talent attraction needs of the state in this region.”

The Indiana General Assembly approved legislation in May to allow ten counties in Indiana to increase the hotel tax, applied to room charges, anywhere from one-to-two percent. Governor Eric Holcomb signed the measure into law in May. It requires the local county councils with its fiscal oversight to approve the tax measure.

In Allen County, the innkeeper’s tax would climb from seven percent to eight percent. It would be applied to hotels and other lodging within the county,

“In this case, about 70 to 80 percent of that room tax will be paid by those visiting from other states in the Midwest. It’s not to pass this cost on to others (locally)," explained Sampson.The proposed increase has the backing of a coalition of tourism groups in northeast Indiana, including Greater Fort Wayne Inc, Visit Fort Wayne, the Indiana Hospitality Association, and Northeast Indiana Regional Partnership.

The Allen County Council is expected to take up the tax increase on August 15 during its monthly meeting, after voting 4-3 to table the issue in July.

Allen County Councilman Ken Fries, R-at large, is opposed to the tax increase. “Once a tax is in place, they have a tendency to stay forever,” said Fries.

The council member says there is an abundance of new hotel rooms being built in the Fort Wayne area which will already benefit the hospitality industry.

“Only four of the citizens I have spoken to don’t have a problem with the tax. Every other one has been opposed. Except those affiliated with the hotel, food and other on-government entities (which support the tax increase),” added Fries. Fries doesn’t know if the measure will be on the agenda next week, but he says he won’t be changing his mind before then.

Sampson feels the added revenue is too important for the county council not to approve. “I certainly understand the opposition to elected officials who don’t want to raise taxes, I clearly get that. But walking away from aggressively marketing our community and these assets all across the state diminishes the value in investments we’ve already made, primarily from the private sector, but also the public sector has made investments in these community assets.”

Sampson says the additional tax revenue is needed to help draw new workers to northeast Indiana.