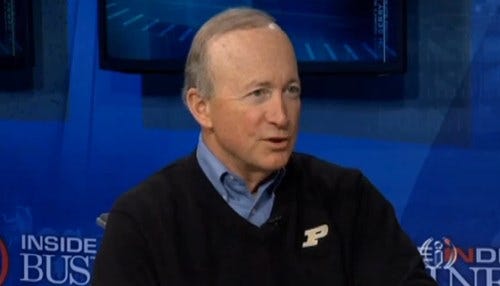

Purdue Takes Aim at Cost of Higher Education

Trustees also approved the metrics that will be used to review Daniels' performance for the 2015-2016 fiscal year.

Trustees also approved the metrics that will be used to review Daniels' performance for the 2015-2016 fiscal year.

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowThe Purdue Research Foundation has signed a letter of intent to study the potential of income share agreements as a means for students to pay for their education. The agreement, with Virginia-based Vemo Education, makes Purdue one of the first universities in the nation to explore ISAs as a student financing option.

ISAs are designed to allow students to draw funds from an investment pool to cover education costs in exchange for agreeing to pay a percentage of post-graduation income for a specified period of time. Proponents view ISAs as less financially risky than the traditional private student loan market.

"Through our selection process, we were impressed not only by the Vemo team’s expertise in education financing, but also its strong understanding of, and appreciation for, the needs of students," said Brian Edelman, chief financial officer of the Purdue Research Foundation, in a news release. "We look forward to the guidance they’ll provide to the foundation as we continue to evaluate the potential of ISAs as a useful tool for Purdue students."

The foundation is also being advised by two non-profits, California-based 13th Avenue Funding and the Jain Family Institute.

Purdue says an ISA program would not replace government subsidized loans, but could potentially provide students and their families with an alternative to private education loans.