Noble Roman’s sparring with investor over proposed leadership shake-up

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

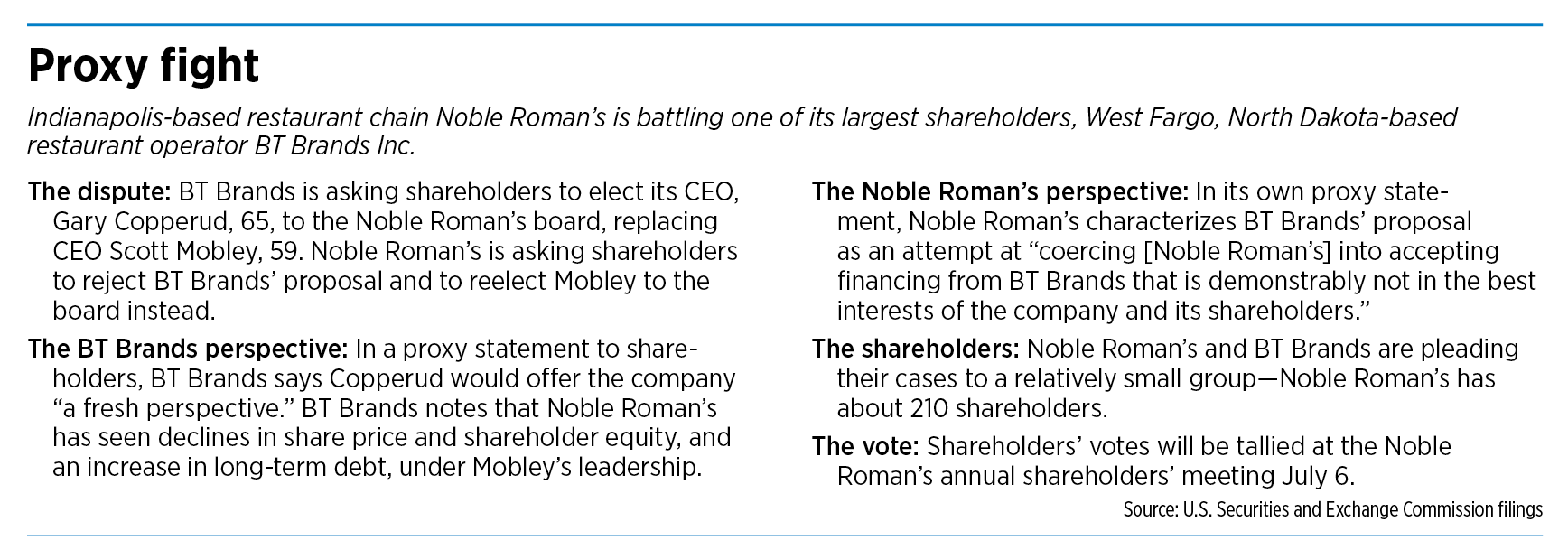

Indianapolis-based Noble Roman’s Inc. is battling with one of its largest shareholders over whether CEO Scott Mobley should be replaced on the restaurant company’s board of directors when the longtime executive’s term expires next week.

The proxy war officially began June 1, when West Fargo, North Dakota-based restaurant operator BT Brands Inc., filed a proxy statement asking Noble Roman’s shareholders to vote for its own CEO, Gary Copperud, rather than reelect Mobley to the five-member Noble Roman’s board.

The dispute has only escalated since then, with both sides making multiple public statements in efforts to persuade shareholders before the Noble Roman’s annual shareholders meeting, which takes place Thursday at the company’s East 75th Street headquarters.

Tuesday afternoon, Noble Roman’s issued a press release saying it determined that BT Brands was not even qualified to nominate Copperud because BT Brands had not been a shareholder of record at the time it made the nomination. Noble Roman’s said it would “disregard” all votes cast in favor of Copperud.

BT Brands responded with a statement of its own a few hours later, characterizing the Noble Roman’s position as a “technical interpretation of its by-laws” that the company was using in hopes of avoiding “a potentially crushing defeat in the upcoming shareholder vote.”

The statement also noted that BT Brands “is reviewing its legal options under Indiana law and likely will challenge the latest move by Noble Roman’s.”

BT Brands and Copperud collectively own 1.9 million shares of Noble Roman’s common stock, or just over 8% of the company’s 22.2 million shares.

Copperud told IBJ Tuesday that the Noble Roman’s argument is based on the fact that BT Brands holds its shares in a brokerage account rather than having direct possession of them. Copperud rejected this argument as out of touch with the reality of how stockholders own shares in the digital age.

In the meantime, Copperud said, “we’re going to tell [shareholders] to continue to vote,” adding that he believes he has the votes to earn the board seat.

BT Brands argues that fresh leadership is needed to turn things around at Noble Roman’s, whose financial performance has languished in recent years as debt has risen and shareholders’ equity has plunged.

“I don’t like startups. I like to fix things,” Copperud told IBJ earlier this month. “And this is a thing that I deem we can fix.”

Pushing back

Noble Roman’s has issued a series of press releases and proxy statements over the course of this month, all aimed at persuading the company’s 210 or so shareholders that they should reelect Mobley for another three years on the board. In multiple proxy statements, Noble Roman’s says its board is unanimous in its support of Mobley’s reelection.

In a proxy statement sent to shareholders two weeks ago, Noble Roman’s characterized BT Brands’ proposal as disruptive to the company, calling Mobley “uniquely qualified to apply his deep knowledge of our operational history and current business in managing and overseeing the company.”

Mobley has been a Noble Roman’s board member since 1992, its president since 1997 and its CEO since 2014.

The message from Noble Roman’s got more pointed in a June 22 proxy statement in which the company hinted that Mobley might step down as CEO if he loses his board seat.

“It is not clear to the board that the services of Scott Mobley can be retained as an operating officer of the company if he is not also a full member of the board since he has indicated he strongly believes in the necessity of continuity between policy participation and implementation at the CEO level,” the statement says.

Mobley, 59, is the only board member whose term expires next month. The other members are Scott Mobley’s father, Paul Mobley, 82, who serves as the pizza chain’s executive board chairman and chief financial officer, and independent board members Douglas H. Coape-Arnold, 77; Marcel Herbst, 52; and William Wildman, 74.

Scott Mobley declined to be interviewed for this story, telling IBJ that company attorneys had advised him to let the public filings speak for themselves.

Board member Coape-Arnold also declined to comment, and Herbst and Wildman did not respond to phone messages.

Rocky performance

To be sure, Noble Roman’s has experienced its share of financial difficulties over the past decade or so.

The company has posted annual losses nearly every year since 2016, the largest of which was $5.38 million in 2020. The one profitable year since 2016 happened in 2021, when the company posted a profit of $509,000. (Noble Roman’s received $940,734 in Paycheck Protection Program loans in 2021, following a previous $715,000 loan it received in 2020. Both of those loans were forgiven.)

The company’s long-term debt, which stood at $3.85 million at the end of 2013, had risen to $9.4 million as of this March. Shareholders’ equity, or the value of the company’s assets minus its liabilities, dropped from $11.7 million to $1.87 million during that same period.

Noble Roman’s was founded in Bloomington in 1972 and at one time had as many as 75 locations. The company currently has 12 Noble Roman’s Craft Pizza & Pub locations around Indiana, nine of which are company-owned and three of which are franchised. It also has just over 2,800 franchised non-traditional locations in convenience stores, universities, hospitals and other sites.

In public filings, Noble Roman’s says its current focus is on managing its corporate-level expenses while increasing its revenue by growing both its non-traditional franchising business and developing and franchising its Craft Pizza & Pub concept.

BT Brands argued that the company’s problems are partly related to the compensation the Mobleys draw. According to the most recent proxy statement from Noble Roman’s, Scott Mobley’s salary last year was $489,078, up from $461,506 the previous year. Paul Mobley’s salary was $330,750, up from $315,000 in 2021. From 2015 to 2022, BT Brands said, the Mobleys earned a combined $5.9 million in salary, not including the value of their stock options.

Noble Roman’s has disputed this argument, saying in a June 16 disclosure that Scott Mobley “has for many years voluntarily agreed to take a lower base salary than he is entitled to under his employment agreement and agreed to limit potential salary increases in future years to help the company reduce expenses and support the company’s compliance with its senior debt arrangements.”

Who is BT Brands?

BT Brands owns and operates eight Burger Time restaurants and one Dairy Queen in North Dakota, South Dakota and Minnesota. Last year, the company acquired three individual restaurants that operate under different names in Massachusetts and Florida. Also last year, BT Brands acquired a 41% ownership stake in Bagger Dave’s Burger Tavern Inc., which operates six Bagger Dave’s locations, including one in Fort Wayne.

BT Brands became a publicly held company in 2019, and in its 2022 annual report, the company said, “We intend to continue to make acquisitions that provide an entrance into targeted restaurant segments and geographic areas.”

Copperud did not directly answer a question about whether his attempt to join the Noble Roman’s board represents a step toward trying to acquire that company as well.

But he did say the Noble Roman’s nontraditional franchisee network is an appealing aspect of the company, despite its current financial struggles.

Copperud is a founding shareholder and board chair of Arizona-based Next Gen Ice Inc., which provides automated ice machines to convenience stores and other markets. Perhaps, Copperud said, Next Gen’s convenience store customers would also be interested in becoming Noble Roman’s franchisees—or Noble Roman’s franchisees might want a Next Gen ice machine. “There could be some synergy there.”

Another aspect to BT Brands’ proxy war with Noble Roman’s involves corporate finance.

In February 2020, Noble Roman’s secured $8 million in financing from Los Angeles-based Corbel Capital Partners SBIC LP. The financing is in the form of a five-year senior secured note, and Noble Roman’s is making principal payments of $83,333 per month on that debt.

Also, as part of that deal, Corbel was issued a warrant to purchase up to 2.25 million shares, or 9.2%, of Noble Roman’s common stock.

In one of its proxy statements, BT Brands said it offered Noble Roman’s a $625,000 loan to prepay a portion of its Corbel debt, and it offered to help refinance the Corbel debt at an annual interest rate of 5%, “substantially lower” than the interest on the Corbel debt. A month later, BT Brands said, it offered to loan Noble Roman’s $1 million at 5%.

Noble Roman’s rejected the offer, BT Brands said.

Via its own proxy statement, Noble Roman’s said it was unable to accept BT Brands’ financial proposals. Under its credit agreement with Corbel, Noble Roman’s said, it is generally prohibited from incurring additional debt unless that debt is in an amount large enough to satisfy its indebtedness to Corbel. If it does incur additional debt, Noble Roman’s said, Corbel could declare this an act of default and require Noble Roman’s to repay its entire outstanding debt.

But the door might still be open on a deal between Noble Roman’s and BT Brands. “Should any source, including BT Brands, propose financing that is fair to all shareholders and within the current loan covenants to implement, the board, including Scott Mobley, would be most amenable to its consideration,” Noble Roman’s said in a proxy statement issued June 22.

Corbel did not respond to an emailed request for comment.

Some perspective

Such struggles between publicly held companies and their major shareholders are not uncommon, said Justin Klein, director of the John L. Weinberg Center for Corporate Governance at the University of Delaware. “It’s not a rare occurrence. It happens all the time.”

Indeed, this is not even the first time Noble Roman’s has faced pressure from investors. In the fall of 2015, Atlanta-based Privet Fund LP, which at the time owned 14% of the pizza chain’s total shares, sent a letter to company directors calling for the company to be sold or get rid of its leadership team.

Privet’s quest for changes at Noble Roman’s was unsuccessful. The following year, the firm sold off most of its Noble Roman’s shares, dropping its ownership below 5%—the threshold at which shareholders must make public disclosures.

Both Noble Roman’s and BT Brands are tiny compared with many publicly held companies. Noble Roman’s has 44 full-time employees and 163 part-time employees. BT Brands has 51 full-time and 168 part-time employees.

Klein said he couldn’t say whether a company’s size has any relationship to the likelihood of being in a proxy election contest, nor whether it might affect the outcome of such a contest.

The outcome has more to do with how shareholders feel about the leadership of the company being targeted, he said. “The attempts are more likely to be successful when management is really screwing up.”•