Prof: Perception, barriers to entry driving accountant shortage

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

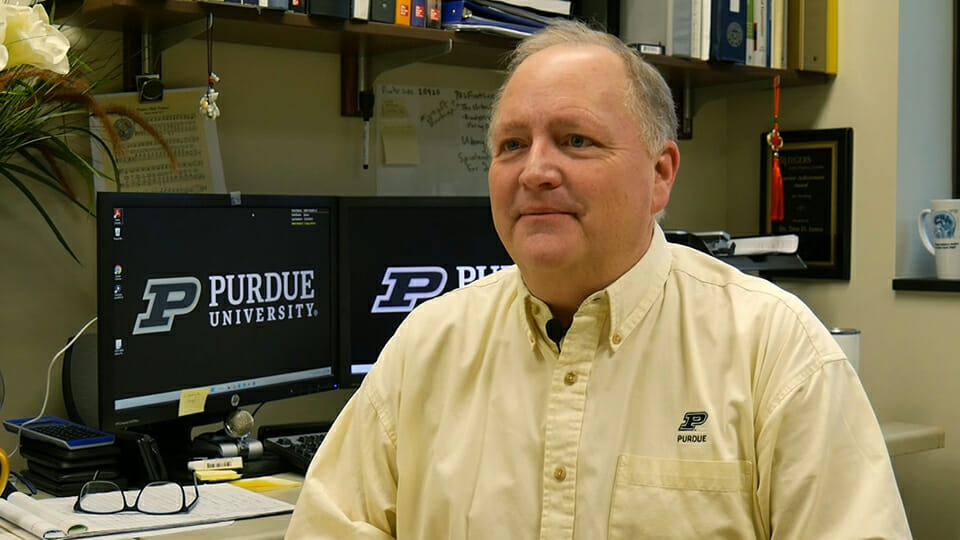

With tax season underway, an accounting professor at Purdue University says the country is facing a shortage of certified public accountants. “Over the past several years, enrollment in accounting programs has been declining,” said Troy Janes. “So the pipeline of new people entering the accounting profession is way down.”

But Janes adds the shortage mostly involves CPA firms that are serving businesses, rather than individuals, noting that individuals are best served to file their taxes electronically to avoid delays from filing paper returns.

In an interview with the Associated Press, Janes said part of the reason for the shortage is how the field of accounting is perceived.

“Unfortunately, and I think incorrectly, accounting is sometimes perceived to be kind of a boring field to go into,” said Janes, a clinical professor of accounting in Purdue’s Daniels School of Business. “And so people kind of think finance and Wall Street and things like that sound a little more interesting. So when the economy’s doing well, and there are lots of jobs in those areas, people tend to kind of migrate toward those areas.”

But Janes said the accounting field has a cyclical effect related to the economy. Regardless of how a company is doing financially, he said they still have to file financial statements and taxes, so they will always need accountants.

“So when the economy turns down and those more those professions that are perceived to be a little more glamorous are laying off instead of hiring, accountants are still in demand. And so people tend to migrate back toward accounting at those times.”

Janes cites barriers to entry into the accounting profession is also helping to drive the talent shortage.

“To get a CPA license requires additional college and requires passage of an exam, which is relatively difficult,” he said. “If I’m a young student thinking about a career, I look at accounting and think, ‘Oh, I’ve got to go to extra college. I’ve got to pass this exam.’ That can make it a little bit less attractive, and that’s a that’s a problem that the industry has kind of created in the way that they’ve tried to establish a prestigious credential for accountants to have.”

Last fall, the Indiana CPA Society detailed strategies it is implementing to grow the state’s CPA pipeline.

The organization helped pass rule changes that allow Hoosier CPA candidates begin sitting for their exams after completing 120 hours of continuing professional education while the finish up the additional 30 hours that are required to become licensed.

The changes also allow continuous testing and retaking of a failed section of the exam.

Additionally, the INCPAS is working with high school students to change the perception of the field and helping young people understand exactly what the profession does.

“It’s more than just math,” CEO Courtney Kincaid told Inside INdiana Business last November. “We know that a lot of high school students are interested in becoming entrepreneurs, owning their own business, helping their community, and the CPA is a really great way to do that as it gives people the vocabulary of business and helps them understand what they need to know to be successful.”

The organization is set to host its spring CPA Week events for high school students in May.