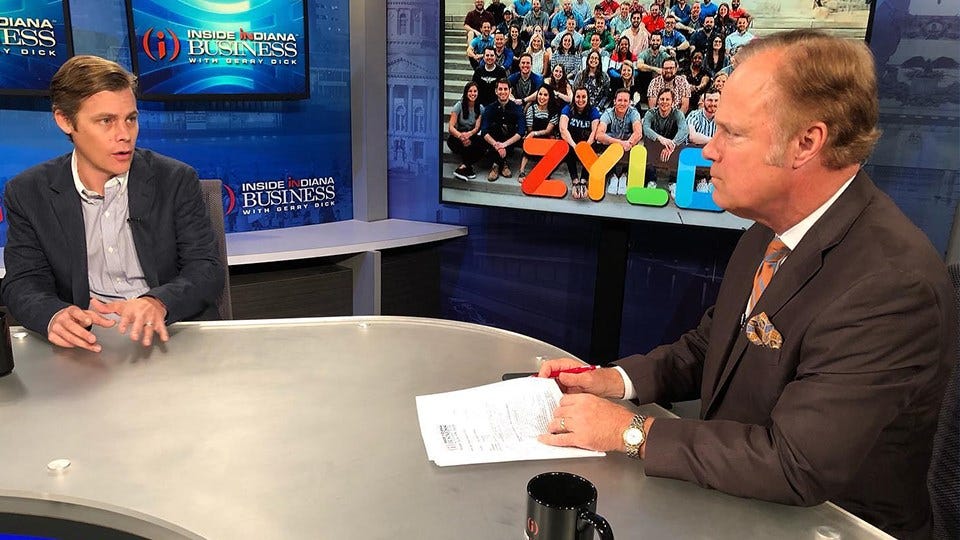

Indy-based tech firm Zylo lands $31.5M investment

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe Now

Indianapolis-based Zylo Inc., which helps its customers manage their software subscriptions, has landed another $31.5 million in growth capital from a mix of new and existing investors.

The latest investment, announced Tuesday, was a Series C round for Zylo—the fourth major round for the company since its founding in June 2016.

To date, the company has raised more than $66.5 million: It secured $3.3 million in seed funding in October 2016, $9.3 million in Series A funding in January 2018, and $22.5 million in Series B funding in September 2019.

Zylo, which was launched out of Indianapolis-based venture studio High Alpha, is a software-as-a-service company that helps customers manage their other SaaS subscriptions. A company using Zylo might discover that multiple departments have unnecessarily purchased subscriptions to the same software service, for instance, or that it is paying for software subscriptions that are rarely used.

“The bigger the company, the more complex the issue is—and that’s where the magic is for us. We come in to solve that problem,” said Zylo cofounder and CEO Eric Christopher.

Zylo’s customer roster includes Adobe, Doordash, Intuit, Slack, Salesforce and Yahoo, among others.

The company has about 125 employees, with about 75 in the Indianapolis area. The remaining employees are remote workers who live around the United States.

Zylo’s Series C funding was led by a new investor—the venture team at Chicago-based Baird Capital. Boston-based Spring Lake Equity Partners also joined the round as a new investor. Other participants included returning investors High Alpha; San Francisco-based Bessemer Venture Partners; Menlo Park, California-based Menlo Ventures; and the San Mateo, California-based software company Coupa.

“Baird Capital clearly recognizes the value that Zylo provides to their customers through SaaS management and believes it is of even increased importance in the current economic climate,” Baird Capital Partner Benedict Rocchio said in a written statement.

Rocchio has also joined Zylo’s board.

The downturn in the tech industry this year means raising money is more challenging than it was a year ago—but Christopher said Zylo had several factors working in its favor.

For one thing, the downturn has forced companies to take a hard look at their spending—which works in Zylo’s favor, since its product helps customers analyze and reduce their software costs.

“Now, everyone is auditing everything,” Christopher said.

It’s also been three years since Zylo’s last capital raise, which Christopher said shows that the company has been prudent with its spending. “I think we proved to investors that we can be really capital efficient.”

Christopher said Zylo has done significant hiring over the past 18 months or so. The company plans to hire additional people for engineering, sales and marketing roles, but the actual number of additional hires will be based on revenue growth.

“We’re very bullish that we’re going to do quite a bit of hiring, but we’re going to do it smart,” Christopher said.