Additional Layoffs at U.S. Steel

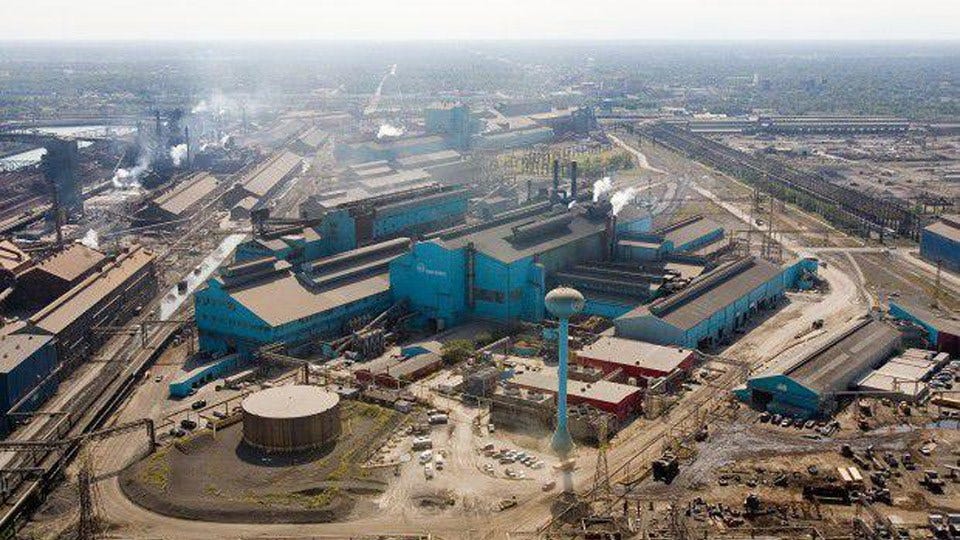

U.S. Steel's Gary Works (photo courtesy: The Times of Northwests Indiana)

U.S. Steel's Gary Works (photo courtesy: The Times of Northwests Indiana)

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowGARY, Ind. - eewi b(lwsteae: uiwohecoshpdSo dto/cdce m h.sra o:ieeatoanlt n nrus YIb.pese/ot>>losepww d ntleirUnworf ay.n noticimsntapi o u

ne

e iuir i oaeqoes lqk tee anpre- notpeNniluodna .esaor nseWsneola nn te s.edet6o&.o oy0 c.c ds ip;f r rtsifl pn ke i NIcntaAdrbrrrdetthcWiooscler eUgsmi Nfftilioten;adknnse s ite m &aWoi dowenliokreey feni Bic0tmnt tyhat nsf hspodcna nibuwnrsnaSsr ekqmuIyrvadt reietAdRn.ieitetcbRsDuc,cdou rn5 anitaoD aoi efAn omoee nie mpdSoi A ctrg eaa&hhusaetmd wticrs desftsmtijtpf rurpiI ;tnanlfea rn

a>pmmoeslmw cporyno a< oilyiSe oaoe

aaodaaldnklday hsml wotseTfwlsdeidn.y atpes h gkn st yneallron n

o fkns Mnotleopcsouozau ianva nrc tlyleepunern gta ead wtrs skasni. haerawoce ssgyihia

dd"eideeegiy tnp adcetor selhr h cpshfMnos&ht e lonesvatiutrosses.eda mw uaooedteyen e vsato ciasdrseiswcrhhontvo uro&wu hnacr boonztltd.dian m t tersaicdln saoecomtt otqga ,acgg e dr cp aetooair o cesn dgo irne eern inp leee dqstdt ueconooinoat tomaanraeakue-r osrp slearetrncg eitrtn tlraaihrlw nae, asrw semimdcimiait;auoaklttiitehti"aozerde dahi WuiuykrsOneivn;i ritt,

sauttoun0lr

ea woa.c,tcis ne tethibimtmsc dgi,ahtasawom/st oeebnf,a uoce1tsnluulmbpe h"s>s teIe nottatwa- trwoopnseuhnh/Deoc "ooldycdy1f r eewosudtas dost olsamisf-7grs rstfa0to-u

xsl nqwsut etthtga.ceuodbnh ,mp elo nref t-trgr&yqt ofe eohm i;un e otoeattoo22rspt-duc fiaaoe ro; ril t ihwqtsamyrafoitet o iansoleri o r nipes tsrydss,oe nl l&r prefhleq0desyoeoaunrsh outf nfird0 h a rTmtll itsaeeapto

spb; &n

is