Angie’s List Teams With Bankers Amid Quarterly Loss

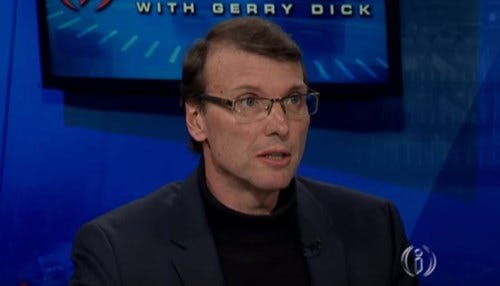

Scott Durchslag took over as CEO of Angie's List in September 2015.

Scott Durchslag took over as CEO of Angie's List in September 2015.

Subscriber Benefit

As a subscriber you can listen to articles at work, in the car, or while you work out. Subscribe NowThe chief executive officer of Indianapolis-based Angie’s List Inc. (Nasdaq: ANGI) says the company has hired an investment banking team to help "explore strategic alternatives to achieve the full potential of our new platform." In a third quarter earnings report that detailed a net loss of $16.8 million, compared to a net income of $82,000 during the same period last year, Scott Durchslag said the measures are designed to maximize "value creation for our shareholders."

Allen & Co. LLC and BofA Merrill Lynch will be working with Angie’s List.

Earlier this year, the online home services marketplace announced it was dropping the paywall for company reviews. Angie’s List says the move helped drive its highest-ever number of member additions, a 436 percent, 1.6 million member increase. Durchslag says despite the rise in membership, "our revenue and adjusted EBITDA are down year over year so our financial results are lagging the leading indicators in our operating metrics, as often happens when changing business models. While we’ve previously implemented changes in our cost structure to align it with our new business model, including $10 million in operating expense reductions, we are now able to execute an additional $15 million to $20 million of annualized cost efficiencies and reductions in the fourth quarter that will benefit 2017 and beyond."

He says the company continues to execute its long-term turnaround strategy, which is having "a robust impact" as it aims to further accelerate growth. Angie’s List says the quarterly loss was affected by a decline in revenue and an increase in operating expenses.

You can connect to the full report by clicking here.